In the aftermath of Hurricane Sandy, stories have emerged of homeowners whose hazard insurance coverage was too low to cover the damage to their respective properties.

In the aftermath of Hurricane Sandy, stories have emerged of homeowners whose hazard insurance coverage was too low to cover the damage to their respective properties.

Unfortunately, this scenario is common among U.S. homeowners, and is not just limited to damage from natural disasters. Homeowners in Columbus and nationwide are often woefully under-insured against catastrophe in its many forms.

Whether you’re buying a home, or own one already, revisit your hazard insurance policy choices and be sure that your bases are covered.

Here are four common components of a homeowners insurance policy :

Dwelling/Building Coverage

Look for the amount listed under this section and divide it by the square footage of your home. Talk to your insurance agent, your real estate agent and perhaps even your contractor to determine whether your current coverage is sufficient. Be sure to consider lot size and building materials.

Liability Protection

What if a person is injured on your property and decides to sue? Whether your dog bit someone’s hand or a guest slipped on a wet floor, lawsuits can be expensive. Most liability policies start at $100,000.

Valuable Add-Ons

Few homeowners policies cover valuables such as art, jewelry, antiques, gold, or wine collections. However, you can usually add coverage for these items for a small annual fee. Appraisals are sometimes required.

Condominium Stipulations

When you live in a condominium or a co-op, the building often has coverage for the “walls out”. Everything inside a unit remains the responsibility of the homeowner. To be sure, however, prior to purchasing coverage for a condo or co-op, show your insurance agent the homeowners association hazard policy for recommendations.

A little bit of insurance coverage goes a long way when it comes to unforeseen disasters — but only if you maintain proper coverage. Speak with your insurance agent regularly to make sure you’ve never under-insured. Accidents, after all, are unexpected by definition.

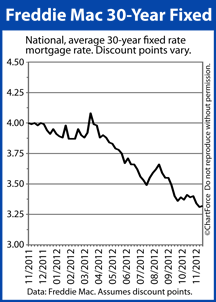

Low mortgage rates are pumping up home affordability.

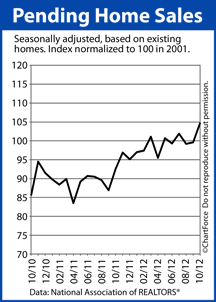

Low mortgage rates are pumping up home affordability. Homes were sold at a furious pace last month.

Homes were sold at a furious pace last month.