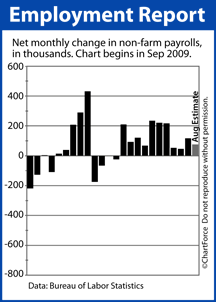

If you’re shopping for a mortgage rate, today may be a good day to lock one down. That’s because Friday morning, the Bureau of Labor Statistics will release its Non-Farm Payrolls report for August 2011.

The “jobs report” tends to have a big influence on mortgage bonds and mortgage rates in Columbus.

The jobs report is a monthly issuance, providing sector-by-sector analysis of the U.S. workforce. It also report the national Unemployment Rate.

Wall Street expects the August Non-Farm Payrolls data to show 75,000 jobs created in August, down from 117,000 in July; and it expects that the Unemployment Rate will remain unchanged at 9.1%.

The jobs report’s connection to mortgage markets is straight-forward — as jobs go, so goes the economy. This is because when the number of working Americans rises :

- Consumer spending gets a boost

- Government tax collection gets a boost

- Household savings gets a boost

These are each good turns in a recovering economy.

For today’s rate shoppers and home buyers, though, it won’t be the actual number of jobs created that matter as much as how close that jobs figure is to Wall Street’s expectations. If the number of jobs created exceeds the 75,000 estimate, look for mortgage rates to rise.

Conversely, if job creation falls short of 75,000 in August, mortgage rates are expected to rise.

Home affordability remains at all-time lows and mortgage rates do, too. If you’ve been wondering whether now is the right time to lock a rate, you can remove some risk by locking ahead of Friday’s Non-Farm Payrolls release.

The report will be released at 8:30 AM ET.