Standard & Poors released its March 2012 Case-Shiller Index last week. The index is meant to measure changes in home prices from month-to-month, and from year-to-year, in select U.S. cities.

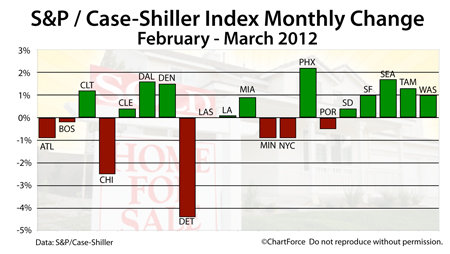

According to the report, home values rose in 12 of the Case-Shiller Index’s 20 tracked markets, and one market remained unchanged.

Of the Case-Shiller markets, Phoenix, Arizona posted the largest one-year gain, climbing 6.1 percent. Atlanta, Georgia posted the largest one-year loss. Values falling more than seventeen percent there year-over-year.

Overall, the Case-Shiller Index was relatively unchanged in March as compared to the month prior, but down nearly 3 percent on an annual basis. Nationwide, says Standard & Poor’s, home values are back to the levels of late-2002.

Don’t be overly concerned, however. Though widely-cited, the Case-Shiller Index is a flawed and misleading metric. It’s methodology almost guarantees it.

The first flaw in the Case-Shiller Index is its limited geography. Despite there being more than 3,100 municipalities nationwide, the Case-Shiller Index tracks just 20 of them. They’re not the 20 largest ones, either. Houston, Philadelphia, San Antonio, San Jose are specifically excluded from the Case-Shiller Index and each is among the Top 10 Most Populous Cities in the United States.

Minneapolis (#48) and Tampa (#55), by contrast, are included.

The Case-Shiller Index’s second flaw is that only tracks the sales of single-family, detached homes. Sales of condominiums and multi-unit homes carry no weight in the index whatsoever — even in cities such as Chicago and New York in which condos can account for a large percentage of the overall real estate market.

And, lastly, when the Case-Shiller Index is published, it’s published on a two-month delay. Buyers and sellers in Cincinnati don’t need housing data from two months ago — they need data from today. The Case-Shiller Index tells us what housing was, in other words. It doesn’t tell us how housing is.

Buyers and sellers need real-time, actionable information. You can’t get that from the flawed Case-Shiller Index. For more accurate, relevant real estate data, talk to your real estate professional instead.