Nationwide, homes continue to sell briskly.

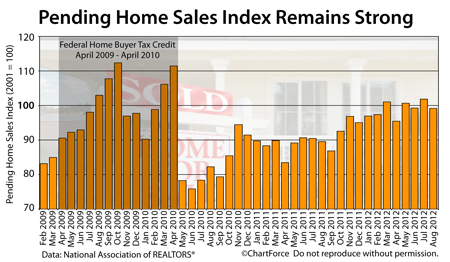

According to the National Association of REALTORS®, the Pending Home Sales Index read 99.2 for August — the fourth straight month in which the index hovered near its benchmark value of 100.

A “pending home” is a home that is under contract to sell, but has not yet closed. The index measures with fair accuracy the future strength of the U.S. housing market.

For today’s Cincinnati home buyers, the August Pending Home Sales Index is relevant for several reasons.

First, the index remains near its highest point since April 2010, the last month of that year’s federal home buyer tax credit. This implies that the current housing market is performing nearly as well as the “stimulated” market of two years ago — except without the accompanying federal stimulus.

The housing market is standing on its own, in other words.

Second, the Pending Home Sales Index suggests that today’s housing market is among the strongest of the last decade. We can make this inference because the Pending Home Sales Index is a relative index, benchmarked to the value of “100” which represents the housing market as it behaved in 2001.

2001 was strong year in housing. With today’s Pending Home Sales Index remaining near 100, it tells us that 2012 is similarly strong.

And, third, the Pending Home Sales Index is relevant because it’s a forward-looking housing metric — one of the few that are regularly published. As compared to the Case-Shiller Index or Existing Home Sales report which both report on how housing fared in the past, the Pending Home Sales Index projects 30-60 days to the future.

Based on August data, therefore, we can expect for home sales volume to remain high as 2012 comes to a close.

If you’re currently shopping for a home, you’ve likely noticed a change in the market. Multiple-offer situations are more common and sellers are regaining negotiation leverage. The longer you wait to buy, therefore, the more you may pay for a home.

Read the complete Pending Home Sales Report on the NAR website.