The home resales is expected to finish the year with strength.

The home resales is expected to finish the year with strength.

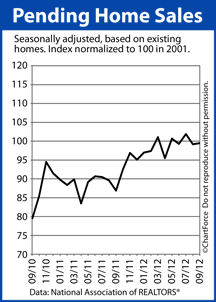

Last month, for the fifth straight month, the Pending Home Sales Index hovered near its benchmark value of 100, registering 99.5 in September.

he Pending Home Sales Index tracks homes under contract to sell, but not yet sold, and is published by the National Association of REALTORS®. The index is a relative one. It compares today’s housing market activity to the housing market activity of 2001 — the index’s first year of existence.

The Pending Home Sales Index has averaged 99.1 this year.

Among housing market indicators, the Pending Home Sales Index is unique. It doesn’t report on prior market activity as the Existing Home Sales and New Home Sales reports do. By contrast, the Pending Home Sales Index is a forward-looking indicator.

The real estate trade association tell us that 80% of U.S. homes under contract go to closing within 60 days, and many of the rest go within Months 3 and 4. In this way, the monthly Pending Home Sales Index can foreshadow to today’s Cincinnati home buyers and sellers what’s next for housing.

Based on September’s Pending Home Sales Index, then, we should expect to see closed home sales stay strong through November and December. That said, home sales are expected to vary by region.

Here is how the Pending Home Sales Index broke down by area last month as compared to one year ago on a seasonally-adjusted, annualized basis :

- Northeast Region : +26.1% from September 2011

- Midwest Region : +19.3% from September 2011

- South Region : +17.6% from September 2011

- West Region : +0.8% from September 2011

Often, the last few months of a year are considered to be a “slow” period for the housing market. Based on regional, annual Pending Home Sales Index improvements, though, 2012 may be different. The market looks poised to finish with momentum that may carry home prices higher into 2013.

For today’s home buyers, mortgage rates remain low and home prices have only started to climb.