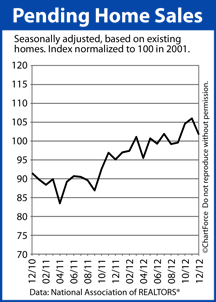

The National Association of REALTORS® (NAR) reports that the Pending Home Sales Index fell 4.3 percent in December as compared to the month prior. The index now reads 101.7.

The National Association of REALTORS® (NAR) reports that the Pending Home Sales Index fell 4.3 percent in December as compared to the month prior. The index now reads 101.7.

The Pending Home Sales Index measures the number of U.S. homes that have gone “into contract”, but have not yet closed. The report is based on data collected from local real estate associations, and from national brokers.

Despite December’s drop, however, the annual rate at which contracts for a home purchase were drawn increased 6.9 percent from one year ago, and marked the 20th consecutive month of annual purchase contract gains.

NAR reports that 80% of homes under contract are closed with 60 days, with the majority of the remained homes “sold” within months 3 and 4.

Analysts believe that December’s Pending Home Sales Index drop is not a result of a weakening housing market. Rather, it’s a function of a falling national home supply; in particular, a shortage of homes in the West Region offered a prices under $100,000.

The national housing inventory is currently at an 11-year low. However, regionally, results varied :

- Northwest : -5.4 percent from November; +8.4 percent from one year ago

- Midwest : +0.9 percent from November; +14.4 percent from one year ago

- South : -4.5 percent from November; +10.1 percent from one year ago

- West: -8.2 percent from November; -5.3 percent from one year ago

Although December’s Pending Home Sales Index dropped as compared to November, the year-to-year growth of pending home sales suggests a broader improvement in the U.S. housing market. Furthermore, the index is a strong indicator of existing home sales, which means that this season’s home sales should outpace those from 2012.

The Pending Home Sales Index is bench-marked to 100, the value from 2001, which was the index’s first year of existence. 2001 was considered a strong year for the housing market so last month’s 101.7 is considered a positive measure for the housing market.

Analysts project a strong Spring market in Louisville and nationwide.