Mortgage markets improved last week as news from the Federal Reserve, the U.S. economy, and Europe combined to spur new demand for mortgage-backed bonds.

Mortgage markets improved last week as news from the Federal Reserve, the U.S. economy, and Europe combined to spur new demand for mortgage-backed bonds.

Conforming mortgage rates rallied from Wednesday through Friday’s close, ending the week near all-time lows set earlier this year.

Last week’s rally was sparked by the Federal Open Market Committee.

After its first meeting of the year, Chairman Ben Bernanke & Co. changed its projection for “exceptionally low rates” to at least late-2014. Previously, the Fed had said its benchmark Fed Funds Rate would remain low until 2013.

This, in conjunction with the Fed’s message that further economic stimulus may be coming, led Wall Street investors to increase their bets on mortgage bonds, pushing up prices and pushing down yields.

Lower yields means lower rates.

Mortgage rates were also helped lower by mixed data on the U.S. economy including weaker-than-expected housing reports, and another setback in the Greece sovereign debt negotiations.

Each time that Eurozone leaders have failed to reach an expected accord with Greece since 2010, mortgage rates have dropped. Last week was no different.

This week, with a large amount of U.S. economic data due for release and a high-profile summit among European Union leaders, mortgage rates are poised to move. Unfortunately, we can’t know in which direction.

Some of the news that will move markets include :

- Monday : Personal Consumption Expenditures

- Tuesday : Consumer Confidence; Case-Shiller Index

- Wednesday : Construction Spending

- Thursday : Weekly Jobless Claims

- Friday : Non-Farm Payrolls;Factory Orders

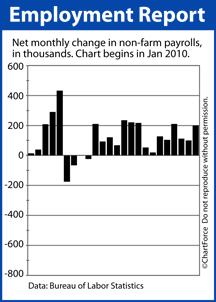

Of all of the economic releases, Friday’s Non-Farm Payrolls has the most potential to move markets. More commonly called “the jobs report”, Non-Farm Payrolls details the monthly change in national employment and the national Unemployment Rate.

Jobs are believed to be the key to U.S. economic recovery so strength in jobs should result in higher mortgage rates throughout OH and the country.

Mortgage rates remain very low. If you’re nervous about mortgage rates rising this week or next, it’s as good of a time as any to lock your rate with a lender, and start moving toward closing.