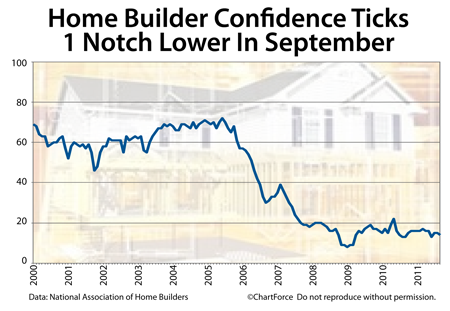

Homebuilders are feeling worse about the market for new homes nationwide.

With construction credit tight and competition from foreclosures increasing, the National Association of Homebuilder’s Housing Market Index slipped 1 point in September, falling to levels just below the index’s 12-month average.

The HMI measures homebuilder confidence nationwide. It’s the result of 3 separate homebuilder surveys, each designed to measure a specific facet of the homebuilder’s business.

- How are market conditions for the sale of new homes today?

- How are market conditions for the sale of new homes in 6 months?

- How is prospective buyer foot traffic?

Each component survey showed a drop-off from August. Responses fell 1 point, 2 points, and 2 points, respectively. Together, September’s composite reading was 14 out of a possible 100 points. Readings over 50 are considered favorable.

The HMI not been above 50 since April 2006.

With homebuilder confidence low — and stagnant — buyers of new homes Louisville in should remain alert for “deals”. Builders are more likely to offer free upgrades and other concessions to incoming buyers. The availability of such deals may increase as the seasons change and as the year comes to a close.

Low mortgage rates are making new homes attractive, too. Last week, 30-year fixed rate mortgage rates fell to their lowest levels of all-time. As compared to just 8 weeks ago, 30-year fixed rate mortgage payments are lower by 5 percent at all loan sizes, down $27 per month per $100,000 borrowed.