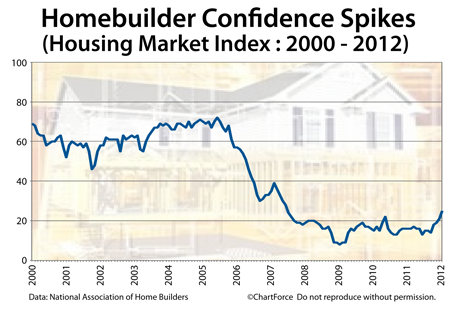

Homebuilder confidence is soaring.

For the fourth straight month, the National Association of Homebuilders reports an increase in its Housing Market Index. The index climbed 4 points to 25 this month — its second four-point gain since October.

With home sales activity increasing across all four regions, the monthly HMI has now nearly doubled in value since June 2011.

The HMI is now at a 55-month high.

The Housing Market Index itself is a composite reading; the result of three home builder surveys sent by the National Association of Homebuilders to its members monthly. Home builders report back on current single-family home sales volume; projected single-family home sales volume for the next 6 months; and current buyer “foot traffic”.

The NAHB then results compiles the surveys into a single reading.

In January, home builders reported improving sales conditions across all three categories :

- Current Single-Family Sales : 25 (+3 from December)

- Projected Single-Family Sales : 29 (+3 from December)

- Buyer Foot Traffic : 21 (+3 from December)

The Housing Market Index corroborates recent U.S. government data that suggests housing is mending in OH. Both Housing Starts and New Home Sales have out-performed expectations of late, it’s been shown, and the stock of new homes for sale nationwide is dwindling.

All of this, of course, is happening as demand from buyers heats up. Foot traffic through builder homes is higher than it’s been in more than 3 years, say the builders — a time period that includes the duration of the 2010 home buyer tax credit.

It’s no surprise, therefore, that builders expect a strong 2012.

Jobs data is improving, mortgage rates remain low, and housing momentum is building. For home buyers in Louisville , however, it may spell higher home prices ahead. Big demand and small supply creates scarcity and scarcity correlates to rising prices.

If you’re shopping new homes, the best “deal” may be the one you find today.