Standard & Poors released its monthly Case-Shiller Index this week. The Case-Shiller Index measures home price changes from month-to-month, and year-to-year, in 20 select U.S. cities. It also reports a “national” index; a composite of the values in said cities.

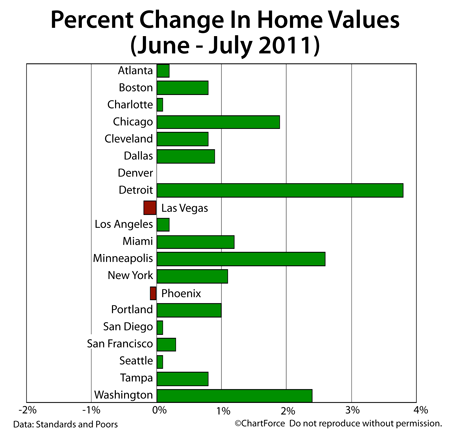

The most recent Case-Shiller Index shows a 0.9% rise in home values from June to July 2011. Home values were higher in 17 of the 20 tracked cities. Only Phoenix and Las Vegas fell. Denver was flat.

Also noteworthy is that, of all of the Case-Shiller cities, Detroit posted the strongest 1-year, home price improvement. As compared to July 2010, home values are higher by 1.2 percent in Detroit. This bests even Washington, D.C. — long-believed to be the nation’s healthiest housing market.

That said, we should be careful of the conclusions we draw from July’s Case-Shiller Index — both on a city-wide level, and on a national level. This is because, as with most “home price trackers”, the Case-Shiller Index has flaws in its methodology.

The first Case-Shiller Index flaw is its limited scope. Although it’s purported to be a “nationa”l housing index, the data that comprises the monthly Case-Schiller Index is sourced from just 20 U.S. cities. These 20 cities represent just 0.6% of the more than 3,100 municipalities nationwide.

The second Case Shiller Index flaw is that the sample sets include single-family, detached homes only. iCondominiums, multi-unit homes, and new construction are specifically excluded from the Case-Shiller Index.

In some markets, “excluded” home types outnumber included ones.

And, lastly, the Case-Shiller Index is flawed in that it takes 2 months to gather data and report it. It’s nearly October, yet we’re still discussing the real estate market as it existing in July. For buyers and sellers in Cincinnati , July in ancient history.

The Case-Shiller Index is useful for tracking long-term trends in housing, but does little to help individuals with their choices to buy or sell a home. For relevant, recent real estate data, talk to a real estate agent in your market. Real estate agents are often the best source for real-time, real estate data.