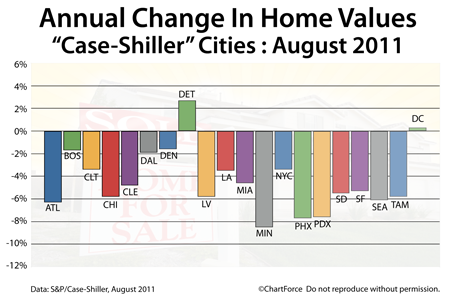

The August 2011 Case-Shiller Index was released this week. On an monthly basis, 10 of 20 tracked markets worsened. On an annual basis, valuation degradation was worse.

Only Detroit and Washington, D.C. posted higher home values in August 2011 as compared to August 2010, rising 2.7% and 0.3%, respectively.

However, the index has been moving in the right direction. Since bottoming out in March of this year, the Case-Shiller Index is up nearly 4 percent.

As home buyers and sellers in Columbus , though, we have to remember that the Case-Shiller Index is a flawed product; its methodology too narrow to be the final word for housing markets.

The Case-Shiller Index has 3 main flaws.

The first Case-Shiller Index flaw is its relatively small sample size. Although it’s positioned as a national housing index, Case-Shiller data represents just 20 cities nationwide, and they’re not even the 20 most populous U.S. cities. For example, cities like Houston (#4), Philadelphia (#5), San Antonio (#7) and San Jose (#10) are excluded from the Case-Shiller Index findings.

By contrast, Minneapolis (#48) and Tampa (#55) make the list.

A second Case-Shiller Index flaw is the way in which it measures home price changes. The Case-Shiller Index formula ignores all home sales except for “repeat sales” of the same home. New homes don’t count for the Case-Shiller Index. Furthermore, the index ignores condominium and multi-family home sales, too.

In some cities, condos can account for a large percentage of sales.

And the third Case-Shiller Index flaw is that the data is reported on a 2-month lag. Next week marks the start of November, yet we’re still discussing data from August. A lot can change in two months (and it often does). Today’s market conditions are similar to — but not the same as — market conditions from before Labor Day.

The Case-Shiller Index is far from “real-time”.

As a monthly release, the Case-Shiller Index does more to help people with a long-term view of housing, including politicians and economists, than it does for everyday buyers and sellers of Montgomery who negotiate prices based on current demand and supply.

A real estate agent can tell you which homes have sold in the last 7 days, and at what prices. The Case-Shiller Index cannot.