Mortgage markets worsened last week as the Federal Reserve’s Federal Open Market Committee suggested economic recovery may be closer than it originally expected, and that inflation may be a near-term economic concern.

Mortgage markets worsened last week as the Federal Reserve’s Federal Open Market Committee suggested economic recovery may be closer than it originally expected, and that inflation may be a near-term economic concern.

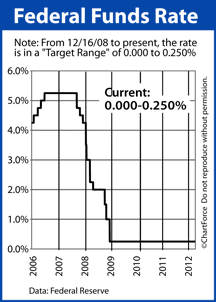

Although the FOMC voted to leave the Fed Funds Rate unchanged in its current range near 0.000 percent, its published comments sparked a broad-based mortgage bond selloff.

Conforming mortgage rates throughout OH rose sharply post-FOMC, climbing by as much as 0.375%.

If you’ve been shopping for a mortgage rate, the run-up was both untimely and unwelcome.

According to Freddie Mac’s weekly mortgage rate survey, for most of the year, conforming 30-year fixed rate mortgage rates had remained within a tight range near 3.90 percent for mortgage applicants willing to pay an accompanying 0.8 discount points.

This week, though, Freddie Mac is expected to report average 30-year fixed rate mortgage rates well north of four percent. It would mark the highest level for the benchmark mortgage rate since mid-December of last year.

There will be a lot more for rate shoppers to watch this week, too. There is a slew of housing data set for release and the heavily-anticipated HARP 2.0 Refinance program “goes live” nationwide.

HARP is a government-led refinance program meant to help underwater homeowners refinance their Fannie Mae- or Freddie Mac-backed mortgages into new loans at today’s low rates.

The program was first launched in 2009 and helped roughly one million U.S. homeowners. HARP’s newest iteration, though, provides for a more lenient underwriting process that is expected to open the program to an additional 6 million homeowners or more.

Mortgage rates may rise this week as a result of HARP-based loan volume. It may also rise on strength in housing — there are four data points due for release :

- Monday : Housing Market Index

- Tuesday : Housing Starts

- Wednesday : Existing Home Sales

- Friday : New Home Sales

As in most weeks, it’s less risky to lock a mortgage rate than to float one. Mortgage rates have much room to climb but very little room to fall. If you’re not yet locked, talk to your loan officer and make a plan.