Mortgage markets improved again last week on a revised economic outlook for the U.S. economy, and ongoing concerns about Greece and its sovereign debt.

Mortgage markets improved again last week on a revised economic outlook for the U.S. economy, and ongoing concerns about Greece and its sovereign debt.

Conforming mortgage rates in OH fell last week and now hover near the all-time lows set last November.

Adjustable-rate mortgages are especially low.

There were three big stories last week that will carry forward into this week.

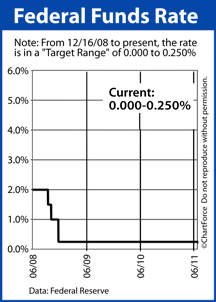

First, the Federal Open Market Committee voted to leave the Fed Funds Rate unchanged in its current target range of 0.000-0.250 percent. This was expected. However, the Fed revised its growth estimates for the U.S. economy lower. This was not expected.

Mortgage rates dipped on the news.

Second, Greece moved closer to avoiding insolvency. The nation-state’s parliament must now pass a package of spending cuts and tax increases to appease Eurozone leaders and the IMF. Without passage, though, bankruptcy may be unavoidable.

Worries about Greece’s fate sparked a bond market flight-to-quality. This, too, helped mortgage rates ease.

And, lastly, Thursday, the U.S. and other members of the International Energy Agency chose to release 60 million barrels of oil to the market over the next month. You’ve likely experienced the impact as the gas pump already — gas prices are way down nationwide.

Lower gas prices means fewer inflationary pressures and inflation is the enemy of mortgage rates. Less inflation, lower mortgage rates.

This week, mortgage rates may reverse.

There isn’t much new data due for release — inflation data due Monday, housing data due Wednesday, and a series of confidence reports throughout the week — but there are 3 scheduled treasury auctions that could pull rates up or down.

- Monday : 2-Year Treasury Note auction

- Tuesday : 5-Year Treasury Note auction

- Wednesday : 7-Year Treasury Note auction

If demand is high at any/all of the auctions, mortgage rates should drop. If demand is weak, mortgage rates should rise.