Low mortgage rates are terrific — if you can get them.

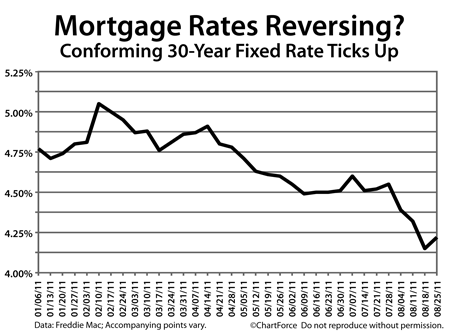

One week after posting its lowest mortgage rate in 50 years, Freddie Mac reports that the 30-year fixed rate mortgage rose by an average of 7 basis points nationwide this week to 4.22%. To get the rate, you’ll pay an average of 0.7 “points”.

This week’s rise in the 30-year fixed rate mortgage pulled rates off their all-time lows so either you locked last week’s rock-bottom rates, or you missed it.

Mortgage rates are rising.

As a refinancing homeowner or home buyer in Cincinnati , rising mortgage rates are something to watch. This is because, as mortgage rates rise, so do the long-term interest costs of giving a mortgage, increasing your homeownership costs.

For example, if you failed to lock a rate last week when rates were bottomed, and then decided to lock-in only after rates had climbed 0.25 percent, at the new, higher rate, over the life of your loan, you would have responsibility for an extra $5,300 in interest costs for every $100,000 you borrowed.

Rising mortgage rates can be expensive.

For home buyers, rising mortgage rates pose a second problem — they erode your purchasing power. A home that fits your budget at today’s rates may not fit your budget at next week’s rates. And because mortgage rates change quickly, you can sometimes feel ilke you’re racing the clock.

The hard part about mortgage rates, though, is that we can never know what they’ll do next. On some days they rise, on some days they fall, and on some days they stay the same. Instead of trying to “time the bottom”, therefore, a good strategy can be to lock the first, low rate that fits your budget. Then, if rates are lower in the future, you can look to refinance at that time.

Mortgage rates remain at historical lows. It’s a good time to lock a rate.