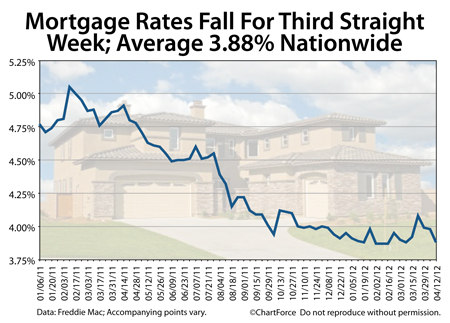

After a brief surge north of 4 percent last month, mortgage rates have settled down, near their lowest levels of all-time.

According to Freddie Mac’s weekly Primary Mortgage Market Survey, for applicants willing to pay 0.7 discount points plus a complete set of closing costs, the average 30-year fixed rate mortgage rate fell to 3.88 percent this week.

0.7 discount points adds $700 to your mortgage closing costs for each $100,000 borrowed.

Mortgage rates are down this week on “safe haven” buying. The move is triggered by Wall Street’s concern that Spain and Italy will have trouble servicing their respective sovereign debt. In response, investors are selling risk-heavy assets and using the proceeds to purchase U.S. government-backed bonds.

This creates demand for mortgage bonds which, in turn, pressures mortgage rates lower.

The storyline is similar to what transpired in Greece last year, and, at least for now, it gives Louisville home buyers reason to cheer. So long as economic uncertainty remains, mortgage rates may stay low.

Of course, like all things in real estate, though, mortgage rates are local. Rates offered by banks varied by region.

Freddie Mac’s survey of 125 banks showed the following regional breakdown :

- Northeast Region : 3.88% with 0.8 discount points

- West Region : 3.85% with 0.8 discount points

- Southeast Region : 3.91% with 0.8 discount points

- North Central Region : 3.89% with 0.6 discount points

- Southwest Region : 3.90% with 0.8 discount points

The best mortgage “deals” are currently available to North Central Region residents. The most expensive loans are for those in the Southeast.

Relative to history, though, all mortgage rates look inexpensive. Conforming 30-year fixed rate mortgage rates have never been as low as they are today. It’s a bonus for home buyers because cheap mortgage rate yield cheap mortgage payments. Home affordability remains near all-time highs.

If you’re unsure of whether now is a good time to buy or refinance, the answer is yes. Talk to your loan officer to review your mortgage options.