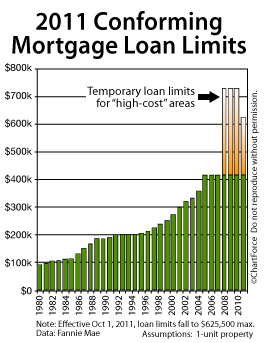

If you live in a high-cost area, keep an eye on your calendar. Effective October 1, 2011, temporary conforming loan limits will be lowered nationwide. Perhaps by as much as 14 percent.

If you live in a high-cost area, keep an eye on your calendar. Effective October 1, 2011, temporary conforming loan limits will be lowered nationwide. Perhaps by as much as 14 percent.

These limits range up to $729,750 currently.

“Temporary loan limits” were enacted as part of the government’s 2008 economic stimulus package. At the time, the financial sector was entering its crisis and private mortgage lending had all but disappeared. Financing was scarce for both homeowners and home buyers for whom loan sizes exceeded Fannie Mae and Freddie Mac’s national $417,000 limit — even for those with excellent credit and income.

The issue was exacerbated in places like New York City where local home prices routinely topped $1 million. Buyers unable or unwilling to bring a substantial downpayment to closing (i.e. $600,000 or more) found themselves without financing.

The February 2008 package addressed this issue, using a math formula to change loan limits in Cincinnati and nationwide. The government assigned to each U.S. metropolitan area a temporary, new loan size limit equal to 25% greater than its respective median home sale price, not to fall below $417,000, and not to exceed $729,750.

Then, later that same year, the Housing and Recovery Act made “high-cost areas” permanent, but with a reduced 15% increase to median home prices, and loan sizes not to exceed $625,500.

These new limits take effect October 1, 2011 — one day after the temporary limits expire.

If you live in a high-cost area, therefore, take note. Mortgage rates may be low, but the amount of loan for which you qualify may be less than you expect, and you may find yourself ineligible.

Whether you’re planning a refinance or a purchase, keep an eye on the calendar.

The complete list of high-cost areas is available online.