Mortgage bonds improved last week on lingering concerns for the European Union, plus weaker-than-expected economic data here at home. Global investors were net buyers of mortgage-backed securities last week, pushing mortgage rates lower nationwide.

Mortgage bonds improved last week on lingering concerns for the European Union, plus weaker-than-expected economic data here at home. Global investors were net buyers of mortgage-backed securities last week, pushing mortgage rates lower nationwide.

According to Freddie Mac’s mortgage rate survey, conforming 30-year fixed rate mortgage rates slipped to 3.79%, on average, last week for borrowers willing to pay 0.7 discount points and a full set of closing costs.

This is the lowest on-record.

15-year conforming fixed rate mortgage rates also fell to a new all-time low, registering 3.05% with 0.7 discount points and closing costs.

1 discount point is equal to 1 percent of your loan size.

Unfortunately, not all mortgage applicants in OH are getting access to Freddie Mac’s posted rates. This is because the “national mortgage rates” assume a 30-day closing window and few banks have been closing loans in 30 days lately. Persistently low mortgage rates have created an appraiser scarcity which, among other reasons, is forcing banks to stretch the traditional 30-day closing window by fifteen days or more.

Longer rate locks carry higher mortgage rates.

For home buyers in Cincinnati , purchase money loans can often be accommodated in 30 days. For refinancing households, however, the process can take up to 60 days. As a result, refinancing homeowners are finding the 3.79% mortgage rates promised by Freddie Mac’s survey somewhat elusive.

This week, though, as chatter of a European Union dissolution grows, investors are seeking safety of principal. Lately, they’ve been finding it in the U.S. mortgage bond market. As demand for mortgage bonds rises, mortgage rates should fall for both 30-day locks and 60-day ones.

This will aid everyone looking for a home loan.

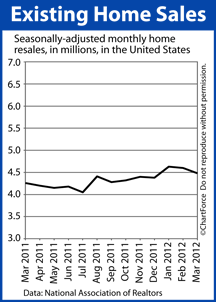

Other news set for release this week includes April’s Existing Home Sales report and New Home Sales report. Both will be closely watched because housing is tied to U.S. economic recovery. Strong results in either data set may push mortgage rates higher.