After two weeks of no change, mortgage markets improved last week, pushing mortgage rates lower throughout Kentucky.

After two weeks of no change, mortgage markets improved last week, pushing mortgage rates lower throughout Kentucky.

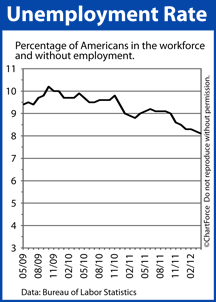

The majority of the improvements occurred Friday after the April jobs report failed to impress Wall Street, and after it became clear that the Eurozone’s struggles with sovereign debt would continue.

According to Freddie Mac, conforming 30-year fixed rate mortgage rates fell to 3.84% nationwide, on average, for borrowers willing to pay 0.8 discount points at closing plus a full set of closing costs.

1 discount point is equal to 1 percent of your loan size such that one discount point on a $200,000 loan would require $2,000 to be paid at-closing.

Freddie Mac’s reported rates for the benchmark 30-year fixed rate mortgage are the lowest in recorded history.

The 15-year fixed rate mortgage is also at its lowest point in history. According to Freddie Mac’s survey, the 15-year fixed averaged 3.07% with 0.7 discount points last week. One year ago, the rate was 3.89%.

This week, with a data-sparse economic calendar, mortgage markets will likely take cues from events in Europe. Notably, France has elected a new leader, one that prefers growth over austerity; and voters in Greece have “punished” austerity-backing leaders, in the process creating a split parliament.

Each event adds uncertainty to an already unstable economic environment and uncertainty favors U.S. rate shoppers.

Doubt spurs investors to seek “safe” assets and U.S. government-backed bonds — including mortgage backed bonds — meet that criteria. As demand for mortgage bonds rise, mortgage rates tend to fall.

This week, rates are starting the week improved. Whether it’s a knee-jerk reaction to Eurozone news from the weekend, or low rates are here to stay is tough to know. Therefore, if today’s mortgage rates look good to you, consider locking something in. There’s more room for rates to rise than to fall.