Recent data suggests that the U.S. housing market is in recovery. However, the data also shows this to be an uneven recovery.

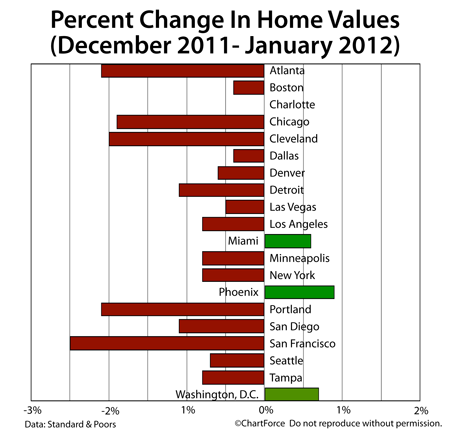

According to the monthly S&P/Case-Shiller Index, for example, home values rose in three of 20 tracked markets between December 2011 and January 2012. 17 tracked markets showed home prices still in decline.

It’s easy to point to the Case-Shiller Index as evidence that the housing market in Kentucky has yet to bottom, but we have to consider the Case-Shiller Index’s shortcomings — specifically in a recovering economy.

For example, the Case-Shiller Index is based on changes in home prices of a single home, through successive sales. This means that to calculate its home price index, the Case-Shiller searches for sales of the same home over a period of time and calculates the difference in contract price.

This methodology can distort the home price tracker downward during times of weak economy because there is no distinction made for homes sold in foreclosure or as a short sale.

35% of all homes sold in January were “distressed”, says the National Association of REALTORS®.

Another distortion in the Case-Shiller Index is that the model neglects all home types that are not of type “single-family residence”. This means that multi-unit homes and condominiums are excluded from the Case-Shiller Index model.

In some markets, such as Chicago and New York City, condominiums account for a large percentage of overall sales.

Lastly, the Case-Shiller Index is published with a “lag”, which renders it useless to buyers and sellers of Louisville in search of real-time, relevant data. The most recent Case-Shiller Index is published with a 60-day delay, and accounts for home purchase contracts written between October and December 2011.

Since October, the U.S. economy has added more than 1 million jobs and the economy has moved into “moderate expansion”, according to the Federal Reserve. Data that’s two seasons old does little to help us today.

Making sound real estate decisions is about having timely, relevant data at-hand when it’s needed. The Case-Shiller Index fails in that respect. It’s good for highlighting the U.S. housing market on the whole, as it existed in the past. For real-time market data, though, you’ll want to talk with an active real estate agent.