For the first time in 3 months, homebuilder confidence has slipped.

For the first time in 3 months, homebuilder confidence has slipped.

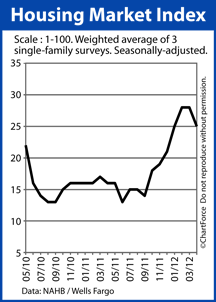

As measured by the National Association of Homebuilders, the Housing Market Index dropped three notches in April to a reading of 25. The report measures homebuilder confidence in the newly-built, single-family housing market.

When the Housing Market Index reads 50 or better, it reflects favorable market conditions. Readings below 50 reflect unfavorable conditions.

According to the scale, not since April 2006 have housing market conditions have been deemed “favorable” but, recently, homebuilder confidence has picked up. Between September 2011 and March 2012, confidence doubled.

April’s reading remains that second-highest since 2007.

So what does “builder confidence” mean? The formula is a little bit tricky.

The Housing Market Index is actually a composite figure. It’s the combined result of three separate surveys sent to homebuilders monthly. The surveys ask about current single-family sales volume; projected single-family sales volume over the next 6 months; and current home buyer “foot traffic”.

The NAHB compiles the results into the Housing Market Index.

In April, builder responses worsened on all 3 questions :

- Current Single-Family Sales : 26 (-3 from March 2012)

- Projected Single-Family Sales : 32 (-3 from March 2012)

- Buyer Foot Traffic : 18 (-4 from March 2012)

At first glance, the data reveals a weakening market for newly-built homes and this may be true; we won’t know for another few months whether April’s confidence setback is an historical blip or the start of a trend. The change in builder psyche, though, is a change that today’s new home buyers in Cincinnati can exploit.

Two months ago, builders expected 2012 to be a banner year for home sales. Today, they’re not so sure.

Buyers of new construction, therefore, may find it easier to negotiate with builders for price reductions, “free upgrades”, and/or other concessions. Plus, with mortgage rates still resting near historical lows, financing a newly-built home is cheaper than at any time in recorded history.

The Spring Buying Season is underway. For buyers of new construction, there are deals to be found.