Mortgage markets improved last week, pushing mortgage rates in Kentucky lower for the second straight week. Conforming fixed and adjustable-rate mortgage cut new, all-time lows, and FHA mortgage rates did the same.

Mortgage markets improved last week, pushing mortgage rates in Kentucky lower for the second straight week. Conforming fixed and adjustable-rate mortgage cut new, all-time lows, and FHA mortgage rates did the same.

In a holiday-shortened trading week, stronger-than-expected U.S. economic data and ongoing weakness within Europe drove investors into the U.S. mortgage-backed bond market. When demand for bonds is high, mortgage rates improve.

The Refi Boom continues.

Since beginning their descent last February, mortgage rates have shed 114 basis points en route to reaching 3.91%, the current, “average”, 30-year fixed rate mortgage rate nationwide and a new all-time low, according to Freddie Mac and its mortgage market survey. If you’re among today’s home buyers or would-be refinancers, on a $200,000 mortgage, the 1.14% rate drop represents a monthly mortgage payment savings of $135 — $1,623 per year.

Larger loans save more, smaller loans save less.

This week, with little economic news set for release, mortgage rates are expected to take their cue from the 8 Federal Reserve members scheduled to speak in public, and from whatever news may bubble up from the Eurozone.

The Federal Reserve said it will communicate its vision for the U.S. economic more openly and more often so Wall Street will be watching the Fed members’ speeches this week, in search of clues about the Fed’s 2012 roadmap.

For example, there has been speculation that a new round of stimulus would be introduced at the Fed’s next meeting later this month. If, after listening to this week’s speeches, investors sense it will happen, mortgage rates may be susceptible to an increase in Louisville and everywhere else.

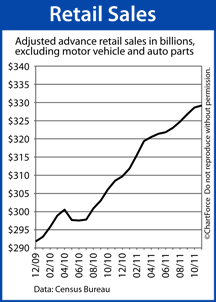

We’ll also be watching the Retail Sales report this week, due Thursday. Retail Sales are a reflection on consumer spending and consumer spending accounts for roughly 70% of the U.S. economy. If Retail Sales make gains, it may spark stock market gains at the expense of mortgage bonds.

This, too, would result in higher mortgage rates.

You can’t time the mortgage market, but with mortgage rates this low, it’s hard to go wrong. Talk with your loan officer to get a live rate quote.