Mortgage markets improved last week as a global flight-to-quality continued. With Spain facing questions on its sovereign debt, investors continued to pare exposure to risky assets, sparking demand for the relative safety of U.S. government-backed mortgage-backed bonds.

Mortgage markets improved last week as a global flight-to-quality continued. With Spain facing questions on its sovereign debt, investors continued to pare exposure to risky assets, sparking demand for the relative safety of U.S. government-backed mortgage-backed bonds.

As a result, conforming and FHA mortgage rates slipped for the third straight week last week.

According to Freddie Mac’s weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage available to borrowers in Ohio is down to 3.88% nationwide with an accompanying 0.7 discount points plus “typical” closing costs.

Last week’s reported 3.88 percent rate for the 30-year fixed rate mortgage is within one-tenth of one percent of the lowest, average mortgage rates in Freddie Mac survey history. However, the last time conforming rates were reported in this range, the accompanying, required discount points were higher than last week’s 0.7.

Meanwhile, at 3.11% nationwide with 0.7 discount points plus closing costs, the 15-year fixed rate mortgage rate is equally low. It, too, set a record last week.

It’s a good time to be looking for a mortgage in Cincinnati. Rates and fees are great.

Last week, markets moved on momentum. This week, they’ll move on data. The economic calendar is busy.

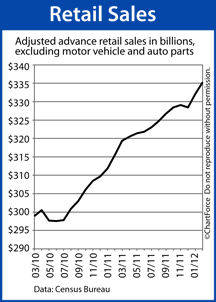

- Monday : Retail Sales; Housing Market Index

- Tuesday : Housing Starts

- Thursday : Weekly Jobless Claims; Leading Indicators; Existing Home Sales

In addition, two Federal Reserve members offer prepared remarks Monday. They will be the last public Fed comments before next week’s 2-day FOMC meeting.

Mortgage rates remain low. Consider calling or emailing your loan officer to learn more about your current financing options.