Mortgage markets worsened last week as Greece tentatively formed a government and the Federal Reserve extended its Operation Twist program by $267 billion.

Mortgage markets worsened last week as Greece tentatively formed a government and the Federal Reserve extended its Operation Twist program by $267 billion.

Neither event, however, removed the uncertainty surrounding global markets.

First, Greece must still adhere to stringent austerity measures in order to meet the terms of its IMF bailout. Its new government, however, may seek to revise the terms of its fiscal austerity, a move that would keep the nation-state — and the European Union — in fragile balance.

As Greece comes closer to resolution, U.S. mortgage rates are likely to rise. This is because economic uncertainty in Greece has helped to keep mortgage rates down since 2010. A reversal in policy would cause mortgage rates to reverse higher.

Second, it’s clear that Wall Street expected more from the Federal Reserve.

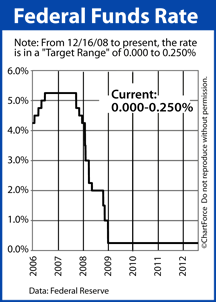

The nation’s central banker made moves to pressure long-term rates lower last week, but did little else to prop up an economy it believes will grow only “very gradually” over the next few quarters. Stock markets got a gentle boost from the Fed’s new stimulus, and mortgage rates suffered only slightly.

Overall, conforming mortgage rates in Ohio rose slightly last week, and much of the action occurred after Freddie Mac’s weekly mortgage rate survey concluded Tuesday afternoon.

According to the government-backed mortgage-securitizer, 30-year fixed rate mortgage rates fell 5 basis points to 3.66% nationwide, on average last week. This was the lowest recorded 30-year fixed rate mortgage rate on record as this year’s Refinance Boom continues.

The 15-year fixed rate mortgage rate also dropped, stopping at 2.95%, on average. This is 0.01 higher than the benchmark rate’s all-time low — a record set two weeks ago.

Buyers and would-be refinancers trying to lock a rate this morning may find pricing to be slightly worse.

This week, mortgage markets will continue to take cues from Europe, and from a bevy of U.S. economic data including the New Home Sales report and the release of the Pending Home Sales Index.

Mortgage rates remain near all-time lows. If you’re considering a home purchase or refinance, the timing looks good.