Mortgage markets worsened last week as the U.S. economy continued to show that it’s in recovery, and as Federal Reserve Chairman Ben Bernanke publicly hinted at the same.

Mortgage markets worsened last week as the U.S. economy continued to show that it’s in recovery, and as Federal Reserve Chairman Ben Bernanke publicly hinted at the same.

In a congressional testimony Wednesday, Chairman Bernanke suggested that new, Fed-led stimulus may not be imminent, surprising Wall Street analysts and market traders who, for months, have expected a third round of quantitative easing from the Fed.

Bernanke’s comments sparked a sharp bond market sell-off that briefly pushed conforming and FHA mortgage rates up 0.375% in Kentucky.

Other relevant data from last week included :

- Core inflation rising 1.9% from last year, below the Fed’s 2.0% target

- Consumer confidence climbing to a 12-month high

- Initial jobless claims falling to a 47-month low

Also, the Pending Home Sales Index posted its highest reading since the end of the 2010 federal home buyer tax credit, suggesting a strong spring housing market.

The economy appears much improved over this time last year.

By the end of the week, mortgage rates had recovered somewhat, but still closed worse on the week. Mortgage rates are higher than their lows of the year.

According to Freddie Mac’s weekly mortgage rate survey, the average 30-year fixed rate mortgage is now 3.90% nationwide with an accompanying 0.8 discount points and a full set of closing costs. Borrowers in Cincinnati wishing to pay no points, or fewer fees, should expect higher rates than the Freddie Mac average.

The average 15-year mortgage rate is 3.17% with 0.8 discount points and closing costs.

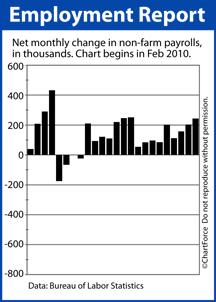

This week, mortgage rates should be volatile. There aren’t many new data points set for release, but the ones on the calendar are bona fide market-movers — especially Friday’s Non-Farm Payrolls Report.

More commonly called the “jobs report”, Non-Farm Payrolls data is closely watched because of the jobs market’s close ties to the health of the economy. Businesses have added jobs through 16 straight months and are expected to show another 210,000 added in February. If the actual number of net new jobs added exceeds 210,000, expect for mortgage rates to rise.

If the number falls short, watch for rates to fall.