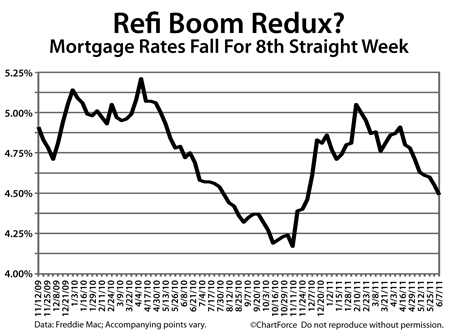

Mortgage rates are falling, falling, falling.

On a wave of uncertainty about Greece and its debt; and weaker-than-expected economic data at home, conforming 30-year fixed rate mortgage rates have fallen to levels not seen since December 2, 2010.

Mortgage rates have dropped 8 weeks in a row. Not even last year’s Refi Boom produced an 8-week winning streak. This season’s streak is historic.

The 30-year fixed rate mortgage now averages 4.49% nationally, down 42 basis points, or 0.42%, since early-April. For every $100,000 borrowed, that equates to a monthly savings of $25.24.

Adjustable-rate mortgages have shed even more, giving back 50 basis points since the streak began.

Because of low rates, it’s an excellent time to buy or refinance a home relative to just a few weeks ago. Note, though, that depending on where you live, you may find your quoted interest rates to be slightly higher or lower than what Freddie Mac reports in its survey. This is because the Freddie Mac figure is a national average.

Mortgage rates and fees vary by region:

- Northeast : 4.49 with 0.6 points

- Southeast : 4.52 with 0.8 points

- North Central : 4.52 with 0.6 points

- Southeast : 4.52 with 0.6 points

- West : 4.45 with 0.8 points

You’ll notice that, in the West Region, rates tend to be low and fees tend to be high; in the North Central Region, the opposite is true. You should expect Ohio to have its own pricing norm within this region, too.

Is there a particular rate-and-fee setup that suits you best? The good news is that you can ask for it — no matter where you live.

If having the absolute lowest mortgage rate is more important to you than having the absolute lowest fees, ask your loan officer to structure your loan in the “West” style. Or, if low costs are more your style, ask for them.

Mortgage rates appears as if they’re headed lower but don’t forget how quickly markets can change. Once they do, mortgage rates in Columbus should spike. Exploit today’s market while you still can.

Leave a Reply