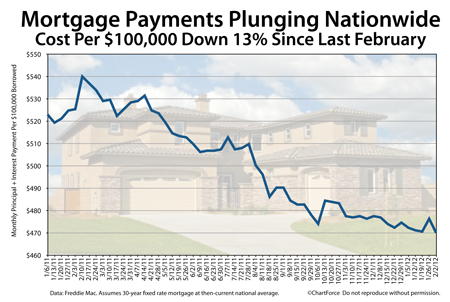

Falling mortgage rates make owning a home more affordable. Mortgage rates are directly tied to monthly mortgage payment so as mortgage rates drop, so does the cost of home-ownership.

It’s a money-saving time to buy a home in Cincinnati — or to refinance one. Mortgage rates have never been this low in history.

According to Freddie Mac, last week, the average 30-year fixed rate mortgage fell to 3.87% nationwide for borrowers willing to pay an accompanying 0.8 discount points plus closing costs. 0.8 discount points is a one-time closing cost equal to 0.8 percent of your loan size, or $800 per $100,000 borrowed.

This represents an incredible value as compared to February of last year.

It was exactly one year ago that mortgage rates begin their long slide lower. On February 11, 2011, the 30-year fixed rate mortgage reached its peak for the year, reading 5.05% in Freddie Mac’s nationwide survey. If you are among the many U.S. households that bought or refinanced a home around that time, you could choose to replace your current home loan with a new one and save close to 13% on your monthly mortgage payment.

13 percent saved on your mortgage is a noteworthy statistic.

Look at this 30-year fixed rate mortgage payment comparison over the last 12 months :

- February 2011 : $539.88 principal + interest per $100,000 borrowed

- February 2012 : $469.95 principal + interest per $100,000 borrowed

Because of falling mortgage rates, a homeowner with a $250,000 30-year fixed rate mortgage would save at least $175 per month just by refinancing into a new loan at today’s mortgage rates. That’s $2,100 in savings per year.

Even after accounting for discount points and closing costs, the “break-even point” on a mortgage like that can come relatively quickly.

We can’t predict mortgage rates so there’s no promise rates will stay like this forever. If you’re planning to buy a home or refinance one, the best way to keep your monthly payments down is to lock your rate while rates are still low.

The market looks ripe for that now.