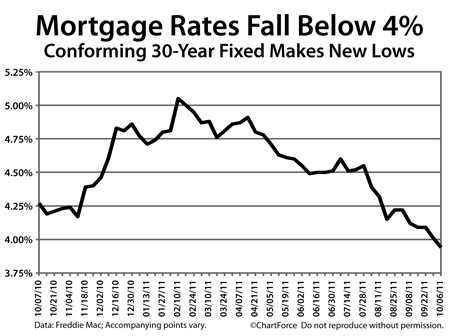

Mortgage rates have dropped past 4 percent.

For the first time in more than 40 years, data from Freddie Mac’s weekly Primary Mortgage Market Survey shows the average 30-year fixed rate mortgage falling below 4 percent, dropping to 3.94 percent nationwide. It’s the lowest average 30-year fixed reading in the survey’s history.

In addition, Freddie Mac shows the 15-year fixed and 5-year ARM making new all-time lows, too, falling to 3.26% and 2.96%, respectively.

It’s a great time to be shopping for a mortgage or buying a home in Cincinnati. Because mortgage rates are dropping, housing payments are dropping, too. As compared to 8 months ago, for every $100,000 borrowed, homeowners now pay $66 less principal + interest each month.

On a $300,000 mortgage, that’s $71,280 saved in 30 years.

Mortgage rates have been lower for several reasons, some of which include :

- U.S. economic growth has been slower-than-expected

- Uncertainty surrounds Greece and the Eurozone

- The Federal Reserve’s “Operation Twist“

In general, demand for mortgage bonds has been high and that’s caused mortgage rates to fall. It should be noted, however, that although the 30-year fixed rate mortgage fell below 4 percent this week, the amount of discount points required to lock that rate rose by 10 basis points, or $100 per $100,000 borrowed.

Homeowners in Ohio are paying bigger fees for these lower rates. If you plan to move within a few years, these fees may wipe out your low-rate savings.

As you shop for a mortgage, pay attention to more than just rates. Low rates are great, but not when they come with high costs. Talk to your loan officer for help with making a plan than works for you.