The housing market continues to improve.

The housing market continues to improve.

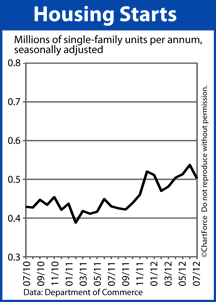

According to the U.S. Census Bureau, on a seasonally-adjusted, annualized basis, Single-Family Housing Starts rose to 603,000 last month, an 11 percent increase from the month prior and the highest reading in more than 4 years.

A “housing start” is a home on which construction has started and home builders are breaking ground at rates not seen even during the 2010 federal home buyer tax credit period.

It’s a signal to home buyers throughout OH that the U.S. housing market may be permanently off its bottom.

At least, the nation’s home builders seem to think so.

Earlier this week, the National Association of Homebuilders reported home builder confidence at a 5-year high and nearly triple the levels of last September.

Buoyed by rising sales volume and the heaviest foot traffic since 2006, builders expect the next 6 months of sales to outpace the current rate. It may spell higher home prices for today’s new construction buyer.

Thankfully, mortgage rates remain low.

As compared to last year, today’s buyers have extended purchasing power. Assuming a 20 percent downpayment and a conforming home loan :

- September 2011 : A $1,000 mortgage payment afforded a purchase price of $202,000

- September 2012 : A $1,000 mortgage payment afforded a purchase price of $226,000

That’s an 11.9% increase in purchasing power increase over just twelve months. When combined with today’s rising rents throughout many U.S. markets, demand for new construction homes remains high and builders have taken notice. Buyers should, too.

With mortgage rates low, low downpayment programs available and home prices poised to rise, it’s an opportune time to be a home buyer. Housing has been trending better since late-2011 and will likely carry that momentum forward into 2013.

If you’ve been shopping new construction, remember that as mortgage rates and home prices rise, home affordability drops.