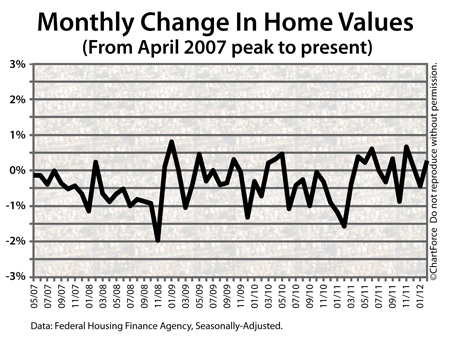

Home prices started the year on an upswing.

According to the Federal Home Finance Agency’s Home Price Index, home prices rose by a seasonally-adjusted 0.3 percent between January and February 2012. The index is up 0.4% over the past year, offering a counter-story to the Case-Shiller Index’s assertion that home values are sinking.

Last week, Standard & Poor’s Case-Shiller Index said home values had dropped more than 3 percent in the prior 12 months.

As a home buyer or seller in Louisville , data showing “rising home values” or “falling home values” may be of interest to you, but we can’t forget that most home valuation trackers — including both the government’s Home Price Index and the private sector Case-Shiller Index — have a severe, built-in flaw.

Both used “aged” data. Today, the calendar reads May. Yet, we’re still discussing February’s housing data.

Data that is two-plus months old is of little value to everyday buyers and sellers wanting to know the “right now” of housing. And, even then, characterizing the data as “two-plus months old” may be a stretch. This is because the home values used in the Home Price index and the Case-Shiller Index are collected from actual transactions, but at the time of closing.

Considering that most purchases require 45-60 days to close, we can know that when we look at the Home Price Index and Case-Shiller Index reports for February, what we’re really seeing is a snapshot of the housing market as it existed two-plus month plus 60 days ago.

Data that’s 5 months old is of little relevance to today’s buyers and sellers. Today’s market is driven by today’s economics.

The Home Price Index is a useful gauge for economists and law-makers. It highlights long-term trends in housing which can be helpful in allocating resources to a particular project or policy. For home buyers and seller throughout Ohio , though, it’s much less useful. Real-time data is what matters to you.

For that, talk to a real estate professional.