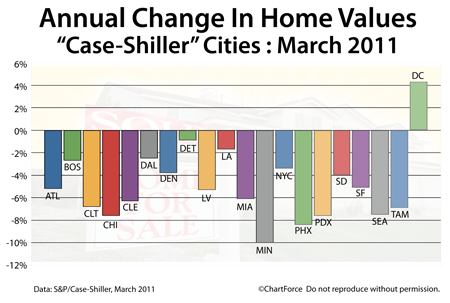

The March Case-Shiller Index was released this week and it corroborates the findings of the government’s most recent Home Price Index — home values are slipping nationwide.

According to the Case-Shiller Index’s publisher, Standard & Poors, home values fell in March from the year prior.

The March report was among the worst Case-Shiller Index readings in 3 years. On a monthly basis, 18 of 20 tracked markets worsened. Only Seattle and Washington, D.C. showed improvement, rising 0.1% and 1.1%, respectively.

On an annual basis, price degradation was even worse.

Washington, D.C. is the only tracked market to post higher home values for March 2011 as compared to March 2010. The national index has now dropped to mid-2002 levels.

As a buyer in today’s market, though, you can’t take the Case-Shiller Index at face value. It’s methodology is far too flawed to be the “final word” in home prices.

The first big Case-Shiller Index flaw is its relatively small sample size. S&P positions the Case-Shiller Index as a national index but its data comes from just 20 cities total. And they’re not the 20 most populous cities, either. Notably missing from the Case-Shiller Index list are Houston (#4), Philadelphia (#5), San Antonio (#7) and San Jose (#10).

Minneapolis (#48) and Tampa (#55) are included, by contrast.

A second Case-Shiller flaw is how it measures a change in home price. Because the index throws out all sales except for “repeat sales” of the same home, the Case-Shiller Index fails to capture the “complete” U.S. market. It also specifically excludes condominiums and multi-family homes.

In some cities — such as Chicago — homes of these types can represent a large percentage of the market.

And, lastly, a third Case-Shiller Index flaw is that it’s on a 2-month delay. It’s June and we’re only now getting home data from March. Today’s market is similar — but not the same — to what buyers and sellers faced in March. The Case-Shiller Index is far less useful than real-time data of a city or neighborhood.

The Case-Shiller Index is more useful to economists and policy-makers than to everyday buyers and sellers in Mesa. For better real estate data for your particular neighborhood, ask your real estate agent for help.

A real estate agent can tell you which homes have sold in the last 7 days, and at what prices. The Case-Shiller Index cannot.

Leave a Reply