Friday morning, the government’s Bureau of Labor Statistics will release its Non-Farm Payrolls report, more commonly called the “jobs report”.

Friday morning, the government’s Bureau of Labor Statistics will release its Non-Farm Payrolls report, more commonly called the “jobs report”.

Depending on how the jobs data reads, FHA and conforming mortgage rates may rise, or fall. This is because today’s mortgage market is closely tied to the U.S. economy, and the U.S. economy is closely tied to job growth.

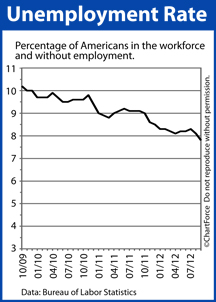

Economists expect that employers have added 125,000 net new jobs to their payrolls in October 2012, up from September’s tally of 114,000 net new jobs. Jobs have been added to the economy over 24 consecutive months leading into Friday’s release, and approximately 4.7 million jobs have been created in the private sector since early-2010.

So, what does this mean for home buyers and refinancing households throughout Columbus ? It means that mortgage rates may get volatile beginning tomorrow morning.

Improving jobs numbers tend to push mortgage rates up, as it signals to investors that the U.S. economy is strengthening. If the actual jobs reports shows more than 125,000 net new jobs created, therefore, look for mortgage rates to rise.

Conversely, a weaker-than-expected report injects fear into the market, causing investors to purchase safer assets including U.S. Treasury bonds and mortgage-backed bonds. This moves mortgage rates lower.

Markets will also watch for the monthly Unemployment Rate. After falling to a 4-year low of 7.8 percent in September, economists anticipate that October’s unemployment rate will rise 0.1 percentage point to 7.9%.

The good news for rate shoppers is that mortgage rates remain low. Freddie Mac’s weekly mortgage rate survey puts the 30-year fixed rate mortgage below 3.50% nationwide for borrowers willing to pay 0.7 discount points. Furthermore, a forecast from the Mortgage Bankers Association predicts that the 30-year fixed rate will remain below 4% for at least the next 8 months and low mortgage rates help to keep home payments low.

The Bureau of Labor Statistics releases the jobs report at 8:30 AM ET Friday.