The FHA is insuring a greater percentage of loans than during any time in recent history. In 2006, it insured roughly 5 percent of the purchase mortgage market. Today, it insures one-quarter. “Going FHA” is more common than ever before — but is it better?

The answer — like most things in mortgage — depends on your circumstance.

Like its conforming counterpart, an FHA-insured mortgage is available as a fixed-rate loan and as an adjustable-rate one. Payments are made monthly and come without prepayment penalties.

That’s where the similarities end, however, and decision-making begins. For homeowners and buyers across Cincinnati , FHA mortgages carry a different set rules as compared to conforming loans through Fannie Mae or Freddie Mac that can render them more — or less — attractive for financing.

For example:

- FHA mortgages can be assumed by a subsequent buyer. Conforming loans may not.

- FHA mortgages require mortgage insurance, regardless of downpayment. Conforming loans do not.

- FHA mortgages do not have loan-level pricing adjustment. Conforming loans do.

FHA mortgages also require smaller downpayment requirements versus a comparable conforming mortgage. FHA calls for a minimum downpayment of 3.5%. Conforming mortgages often require 5 percent or more.

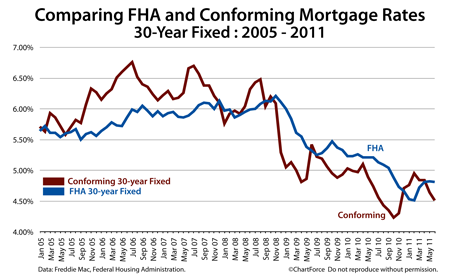

And, lastly, FHA mortgages are priced differently from conforming ones. Since 2005, the average FHA mortgage rate has been below the average conforming mortgage rate more than 50% of the time, meaning that an FHA mortgage’s principal + interest payment is lower than a comparable Fannie/Freddie loan.

Today, conforming mortgage rates are lower.

So, which is better — FHA loans or conforming ones? Like most things in mortgage, it depends. FHA-insured loans can be big money-savers or money-wasters. To find out which is best for you, ask your loan officer for today’s market interest rates and study the results.

With less than 20% equity, the answer is often clear.