The housing market recovery stalled last month. At least temporarily.

The housing market recovery stalled last month. At least temporarily.

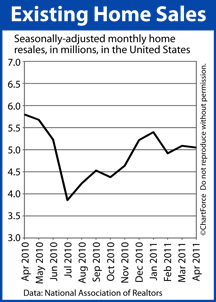

According to the National Association of REALTORS®, Existing Home Sales slipped 1 percent in April from the month prior, falling to 5.05 million units on a seasonally-adjusted, annualized basis. The reading is exactly in-line with report’s 6-month average which also reads 5.05 million units.

The data may appear “average”, but there’s another angle to consider.

In April, as compared to March, the supply of existing homes for sales spiked. At the current pace of home sales, it would now take 9.2 months to exhaust today’s complete home inventory. This is almost one full month worse than March. It’s the worst home supply reading of the year.

There are also more homes “on the market” today than at any time since September 2010.

Other noteworthy statistics in the April Existing Home Sales report include:

- 31 percent of all homes sold in April were purchased with cash

- First-time home buyers bought 36 percent of all homes in April

- Distressed properties typically sold at a 20 percent discount

This “discount”, it should be noted, is a major reason why distressed properties accounted for 37 percent of the home resales in April. Home buyers are finding bargains when they’re willing to consider homes in various stages of foreclosure and short sale.

Overall, the April Existing Home Sales report represents opportunity for home buyers in and around Cincinnati. Home sales are stagnant, supplies are rising and there’s no shortage of properties from which to choose. Furthermore, mortgage rates remain low.

If you’re considering a home purchase this fall, home supply may not be as ample, and financing conditions may not be as favorable, post-Labor Day. Talk to your real estate agent about what’s possible today. You may want to move up your time frame.