Foreclosure rates are falling.

According to foreclosure-tracking firm RealtyTrac, monthly foreclosure filings fell 2 percent in May to just under 215,000 filings nationwide. A foreclosure filing is defined as any one of the following: a default notice, a scheduled auction, or a bank repossession.

On an annual basis, foreclosure counts have dropped over 16 consecutive months, dating back to January 2010.

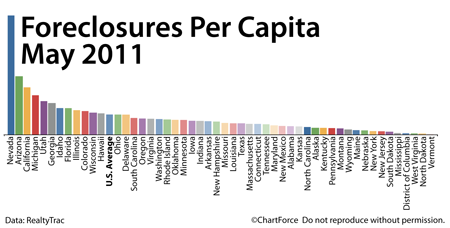

Like all things in real estate, though, foreclosures are local. 6 states accounted for more than half of the country’s foreclosure filings in May. Those six states — California, Michigan, Arizona, Florida, Georgia and Texas — represent just 34% of the U.S. population.

But even on a per household basis, the figures remain disproportionate.

- Top 10 Foreclosure States : 1 foreclosure per 357 households, on average

- Bottom 10 Foreclosure States : 1 foreclosure per 8,764 households, on average

The nationwide foreclosure rate was 1 foreclosure per 605 households.

As a home buyer in Louisville , foreclosures matter. Distressed homes account for close to 40% of home resales and that’s because distressed properties often sell at steep discounts; in some markets, up to 20 percent less than a comparable, non-distressed home. Foreclosed homes can be a great “deal”, therefore, but only if you’ve done your homework.

Buying a bank-repossessed home is different from buying from “people”. The contracts and negotiation process are different, and homes are sometimes sold with defects.

If you plan to purchase a OH foreclosure, therefore, speak with a real estate professional first. With foreclosures, there’s a lot you can learn online, but when it comes time to submit an actual bid, you’ll want an experienced agent on your side.