After a series of months during which foreclosure volume was low, total filings have started to rise again, says RealtyTrac.

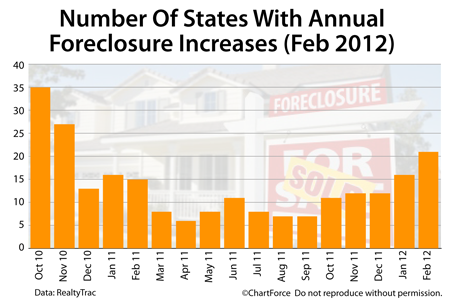

In February, 21 states posted a year-over-year increase in monthly foreclosure filings, according to the national foreclosure-tracking firm. This is nearly twice as many states as compared to December 2011, marking the highest monthly reading since November 2010.

A “foreclosure filing” is defined to include any one of the following foreclosure-related events : (1) The serving of a default notice, (2) A scheduled home auction, or (3) A bank repossession.

Nationally, the number of foreclosure filings fell 2 percent from January. However, it’s a trend that may reverse. Foreclosure volume is expected to rise over the next few months.

This is because the $25 billion mortgage servicer settlement provides a framework for servicers to execute necessary foreclosures, from notice-to-auction. Some analysts believe that foreclosure filings were artificially depressed in 2011 because of the absence of such guidance.

Like all things in real estate, though, foreclosures remain local.

For example, nationally, there was one foreclosure for every 637 housing units. On a state-by-state basis, however, the results looked different.

- Nevada : 1 foreclosure for every 278 housing units

- California : 1 foreclosure for every 283 housing units

- Arizona : 1 foreclosure for every 312 housing units

- Georgia : 1 foreclosure for every 331 housing units

- Florida : 1 foreclosure for every 341 housing units

Even on a city-by-city level, foreclosure concentration varied. Figures from several select cities include :

- Atlanta : 1 foreclosure for every 244 housing units

- Chicago : 1 foreclosure for every 302 housing units

- New York : 1 foreclosure for every 3,439 housing units

- Seattle : 1 foreclosure for every 1,229 housing units

- Washington : 1 foreclosure for every 1,198 housing units

One reason why foreclosure concentration is worth tracking is because homes in various stage of foreclosure are often sold at deep discounts as compared to similar, non-distressed homes. It’s no wonder foreclosed homes are in high demand among today’s Cincinnati home buyers.

However, if you plan to buy a foreclosure in Kentucky , be sure to work with an experienced real estate agent. Foreclosed homes are often sold “as-is”, and may be defective at best and uninhabitable at worst. It makes good sense to have an advocate on your side to help with contracts and inspections.