Mortgage markets improved last week as the U.S. debt ceiling debate continued on Capitol Hill. Bonds traded in a range Monday through Thursday before breaking higher Friday morning.

Mortgage markets improved last week as the U.S. debt ceiling debate continued on Capitol Hill. Bonds traded in a range Monday through Thursday before breaking higher Friday morning.

30-year fixed conforming mortgage rates improved in OH last week, falling to levels just north the product’s all-time low set in November 2010.

5-year ARMs improved last week, too. The benchmark adjustable-rate mortgage’s average national rate is now tied with its all-time low, also set last November.

This week, the direction of mortgage rates depends on two events:

- The resolution of the U.S. debt ceiling debate, due Tuesday

- The July Non-Farm Payrolls report, due Friday

Mortgage rates will be volatile as markets grapple with the expectations for the above events, and their eventual outcomes.

Sunday evening, for example, congressional leaders reached an agreement to raise the U.S. debt ceiling by $2.1 trillion, and to introduce $2.5 trillion in budget cuts within 10 years. The deal must pass Congress, however, and until it does, speculation will push mortgage rates around.

Friday’s jobs report should swing mortgage rates, too.

After starting the year strong, the 2011 jobs market has faded. Net new jobs have dropped 5 months in the row and the national Unemployment Rate is climbing. Weak job growth portends weak consumer spending and a weak economy — typically two outcomes that are good for mortgage rates.

Because of doubt cast by the debt ceiling debate, though, it’s too soon to know how Wall Street will react to the jobs data — strong or weak.

For now, mortgage rates remain low. They may fall further, or they may not. The “safe bet” is to lock.

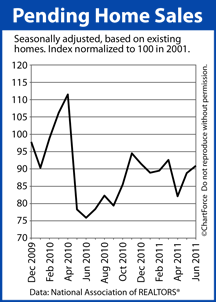

Buyers are writing contracts at a furious pace nationwide.

Buyers are writing contracts at a furious pace nationwide.