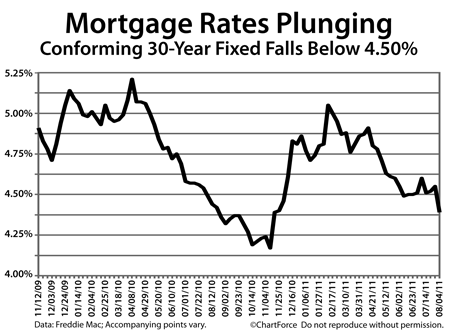

Mortgage rates continue drifting downward, despite — or because of — a ratings downgrade on long-term U.S. government debt. Standard & Poors issued a single-notch downgrade after Friday’s market close, from AAA to AA+.

Mortgage rates continue drifting downward, despite — or because of — a ratings downgrade on long-term U.S. government debt. Standard & Poors issued a single-notch downgrade after Friday’s market close, from AAA to AA+.

Of the roughly $9.4 billion in publicly-held U.S. debt, 72 percent is long-term (i.e. with duration of 2 years or longer).

U.S. short-term debt was not downgraded.

When an entity — government, business, or other — is cited for a credit downgrade, it means that the risk of lending money to that entity has increased. In theory, higher risk should lead to higher borrowing costs and higher consumer rates.

Except in today’s U.S. Treasury and mortgage bond markets, the opposite is occurring. U.S.-backed bonds are in demand, leading rates lower. It’s an unexpected response to the S&P downgrade.

There are 3 main reasons why mortgage rates aren’t rising.

First, Wall Street is “brushing off” S&P’s downgrade, citing the rating agency’s opinion as flawed. This is, in part, the result of a supposed “math error” in the S&P findings, as caught by the U.S. Treasury.

Second, global finance leaders have made public statements since the Friday downgrade re-asserting their faith in the U.S. government’s ability to repay its debts. This is helped stabilize bonds as well.

And, third, of the three major rating agencies, only Standard & Poor’s downgraded long-term U.S. debt. Competitors Moody’s and Fitch instead chose to re-affirm the top-status rating for U.S. government-issued debt after last week’s debt ceiling accord.

The likely cause for falling rates today is that the global economy is showing signs of a slowdown and the U.S. Treasury market remains the largest and most liquid bond market in the world. Ergo, they’re relatively safe — despite the credit rating of the nation backing them.

Mortgage markets were especially volatile last week, taking rate shoppers in Kentucky on a roller-coaster ride. The week’s news schedule was full. It included debt ceiling debates, jobs figures, and ongoing maneuverings within the Eurozone.

Mortgage markets were especially volatile last week, taking rate shoppers in Kentucky on a roller-coaster ride. The week’s news schedule was full. It included debt ceiling debates, jobs figures, and ongoing maneuverings within the Eurozone.