Homebuilder confidence is rebounding sharply.

Homebuilder confidence is rebounding sharply.

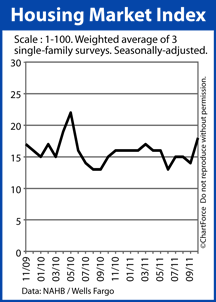

Just one month after falling to a multi-month low, the Housing Market Index rebounded four points to 18 for October. It’s the highest reading for the HMI since May 2010 — the month after last year’s homebuyer tax credit expiration.

The Housing Market Index is published monthly by the National Association of Homebuilders and is scored on a scale of 1-100. Readings above 50 indicate favorable conditions for homebuilders. Readings below 50 indicate unfavorable conditions.

The index has been below 50 since May 2006 — a 66-month streak.

The Housing Market Index is a composite reading; the result of three separate surveys sent to home builders each month. Builders are asked about current single-family home sales volume; projected single-family home sales volume over the next 6 months; and current “foot traffic”.

In October, builder responses were stronger in all 3 categories :

- Current single-family sales : 18 (+4 from September)

- Projected single-family sales : 24 (+7 from September)

- Buyer foot traffic : 14 (+3 from September)

Meanwhile, of particular interest to today’s Louisville home buyers is that builders expect volume to surge over the next two seasons. And, with current sales volume rising and foot traffic strengthening, the fall and winter months could be strong ones in the new homes market.

In addition, the builder trade group press release states that rising costs for materials are squeezing building profit margins.

For buyers, it all adds up higher home prices ahead. As builders grow more confident about the housing market, they’re less likely to make concessions on pricing or upgrades. Rising building costs fortify that argument. The “great deal” will be tougher to negotiate.

At least mortgage rates are low.

Low mortgage rates are keeping homes affordable in Kentucky and nationwide. If you’re looking for the right time to buy new construction, therefore, this month may be it.

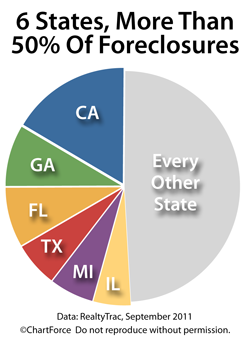

Foreclosure activity continues to slow throughout the United States.

Foreclosure activity continues to slow throughout the United States.