The new construction housing market continues to show strength across the country.

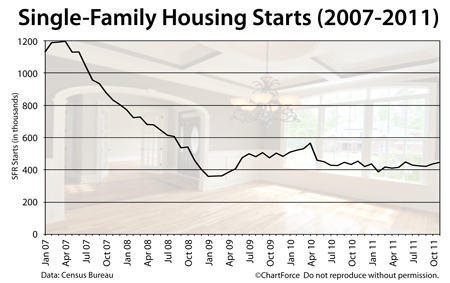

According to the U.S. Census Bureau, Single-Family Housing Starts rose to 447,000 units on a seasonally-adjusted, annualized basis in November — a 2 percent increase from October.

A “Housing Start” is defined as breaking ground on new home construction.

November’s figures mark the third straight month of Single-Family Housing Starts gains. The new construction metric is now 15 percent above its all-time low, set in February of this year.

None of this should be a surprise to new home buyers in Louisville.

Housing data has been trending better since September with sales volumes rising and home inventories falling. Basic economics tells us that home prices should soon rise.

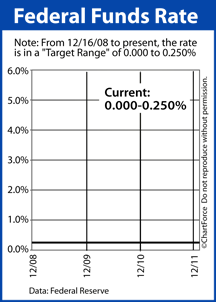

The good news is that low mortgage rates should keep homes affordable.

Since mid-November, the average, conventional 30-year fixed rate mortgage has hovered near 4.000% nationwide with an accompanying 0.7 discount points plus closing costs. 1 discount point equals one percent of your loan size. This is down from near 4.500% six months ago, and the drop has made a big impact on home affordability.

- June 2011 : $200,000 mortgage costs $1,013.37 per month

- December 2011 : $200,000 mortgage costs $954.83 per month

This represents $700 in savings per year. It’s no wonder home builders report the highest buyer foot traffic in 3 years.

Meanwhile, the market shows little signs of slowing down. Building Permits are on the rise, too.

Permits for single-family homes rose to their highest levels of year in November and 89 percent of those homes will start construction within 60 days. This means that Single-Family Housing Starts should stay strong through the early part of 2012, and into the spring.

If you’re planning to buy new construction in Kentucky , therefore, talk to your real estate agent soon and consider moving up your time frame. With mortgage rates low and next year’s buying season approaching, you may find that the best “deals” will come within the next few weeks only.

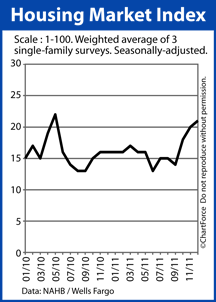

In another good sign for the housing market, today’s home builders believe that the housing market has turned a corner.

In another good sign for the housing market, today’s home builders believe that the housing market has turned a corner. Mortgage markets improved last week, but by a slight amount only; not enough to move conventional mortgage rates in Ohio in any significant manner.

Mortgage markets improved last week, but by a slight amount only; not enough to move conventional mortgage rates in Ohio in any significant manner.