Foreclosure filings are fewer these days, according to foreclosure-tracking firm RealtyTrac.

In December 2011, the number of foreclosure filings nationwide fell 9 percent from the month prior. Not since November 2007 has foreclosure activity been this sparse across the country.

The drop does not appear to be seasonal, either.

Last month’s foreclosure filings were down 20 percent from December 2010 with “foreclosure filing” defined to include any one of the following foreclosure-related events : (1) The serving of a default notice, (2) A scheduled home auction, or (3) A bank repossession. As a result of a unexpectedly strong year-end, 2011’s annual foreclosure rate was the lowest in 4 years.

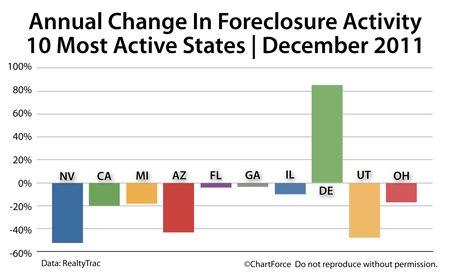

One reason why the year may have closed so strongly is that Nevada, California, Michigan and Arizona — four states typically associated with high rates of foreclosures — each posted big drops in foreclosure filings between November and December, plus double-digit drops between December 2010 and December 2011.

In fact, among the country’s top 10 states for foreclosure activity, nine showed an annual foreclosure filing reduction.

Only Delaware worsened.

It’s also noteworthy that just 4 states accounted for half of last month’s total foreclosure filings.

- California : 25.8 percent of all foreclosure filings

- Florida : 12.0 percent of all foreclosure filings

- Michigan : 6.4 percent of all foreclosure filings

- Illinois : 6.2 percent of all foreclosure filings

Foreclosures are heavily concentrated, in other words. By contrast, the last 1% of activity is spread across 14 states.

As a Cincinnati home buyer — first-timer or investor — foreclosures can be a great way to find value.

According to the National Association of REALTORS®, distressed homes typically sell at “deep discounts” as compared to like, non-distressed homes. However, when you buy a foreclosure home from a bank, it’s different from buying a home from a “person”. Purchase contract negotiations are different and months may pass before your closing is approved.

If you’re buying foreclosure, therefore, seek the help of a professional real estate agent. Real estate agents have experience working in the process-heavy world of foreclosures and can help you come out ahead.

Mortgage markets gained last week, picking up momentum into the weekend. Global demand for mortgage-backed bonds helped push mortgage rates to new lows, and closing costs eased somewhat, too.

Mortgage markets gained last week, picking up momentum into the weekend. Global demand for mortgage-backed bonds helped push mortgage rates to new lows, and closing costs eased somewhat, too.