New Home Sales slowed into the New Year but the market for newly-built homes remains strong. For home buyers in Ohio and nationwide, December’s New Home Sales report is yet one more signal that the housing market recovery may be underway.

According to the Census Bureau, the number of new homes sold in December 2011 slipped 2 percent to 307,000 units on a seasonally-adjusted, annualized basis nationwide.

A “new home” is a home that is considered new construction; a home for which the buyer will be the first owner and tenant.

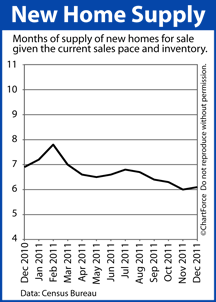

As compared to December 2010, last months’ sales volume fell seven percent. It’s a statistic that suggests housing market weakness. However, in looking at a different component of the New Home Sales report — the supply of homes for sale — we’re forced to reconsider.

At the current pace of sales, every new home for sale nationwide would be “sold” in a matter of 6.1 months.

Economists believe that a 6.0-month supply defines a market in balance — anything quicker is termed a “seller’s market”. Statistics like that are enough to create urgency among today’s Cincinnati home buyers.

Unfortunately, the Census Bureau’s data may be wrong.

Although December’s New Home Sales report shows sales down 2 percent, the government’s data was published with a ±13.2% margin of error. This means that the actual New Home Sales figure may have been as low as -15.2 percent, or as high as +11.2 percent. And, because the range of possible values includes both positive and negative numbers, the Census Bureau had no choice but to assign its December data “Zero Confidence”.

It will be a few months before final revisions are made to December New Home Sales data. Until then, therefore, buyers should take cues from the market-at-large and the market-at-large hints at recovery. One example of this is homebuilders showing more confidence in their product than at any time in the last 5 years.

If your plans for 2012 call for buying new construction, therefore, consider using this lull to “make a deal”. As the year progresses, the great values in housing may be gone.

Mortgage markets improved last week as news from the Federal Reserve, the U.S. economy, and Europe combined to spur new demand for mortgage-backed bonds.

Mortgage markets improved last week as news from the Federal Reserve, the U.S. economy, and Europe combined to spur new demand for mortgage-backed bonds.