New construction buyers in Cincinnati , look out. The nation’s home builders are predicting a strong 2012 for new home sales. It may mean higher home prices as the spring buying season approaches.

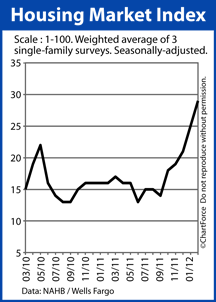

For the sixth straight month, the National Association of Homebuilders reports that homebuilder confidence is on the rise. The Housing Market Index climbed four points to 29 in February, the index’s highest reading since May 2007.

The Housing Market Index is now up 8 points in 8 weeks. The last time that happened was June 2003, a month during which the U.S. economy was regaining its footing, much like this month. It’s noteworthy that June 2003 marked the start of a 4-year bull run in the stock market that took equities up 54%.

The NAHB’s Housing Market Index itself is actually a composite reading. It’s the end-result of three separate surveys sent to home builders monthly.

The association’s questions are basic :

- How are market conditions for the sale of new homes today?

- How are market conditions for the sale of new homes in 6 months?

- How is prospective buyer foot traffic?

In February, builders reported marked improvement across all three areas. Builders report that current home sales climbed 5 points; that sales expectations for the next 6 months climbed 5 points; and that buyer foot traffic climbed 1 point.

Most notable of all of the statistics, though, is that the nation’s home builders report that there are now twice as many buyers setting foot inside model units as compared to just 6 months ago.

This data is supported by the monthly New Home Sales report which shows rising sales and a shrinking new home inventory.

Because of this, today’s new home buyers throughout Ohio should expect fewer concessions from builders at the time of contract including fewer price breaks on a home and fewer free upgrades. Builders are optimistic for the future and, therefore, may be less willing to “make a deal”.

This spring may mark the best time of year to buy a new home. 60 days forward, it may be too late.