Foreclosure filings fell 19 percent last month versus one year ago, says foreclosure-tracking firm RealtyTrac. It’s yet one more signal that the U.S. housing market may have already climbed off its bottom.

According to RealtyTrac, a “foreclosure filing” is any one of the following foreclosure-related events : (1) A default notice on a home; (2) A scheduled auction for a home; or, (3) A bank repossession of a home.

In looking at the January 2012 figures :

- Default Notices were down 22% from January 2011

- Scheduled Auctions were down 19% from January 2011

- Bank Repossessions were down 15% from January 2011

On a monthly basis, however, the numbers weren’t so promising.

Default notices and scheduled auctions were mostly unchanged, but bank repossessions rose 8 percent. The rise in bank repossessions is likely because 2010’s robo-signing controversy has been rectified at the state and lender level.

This trend toward more bank-owned homes is expected to continue through 2012.

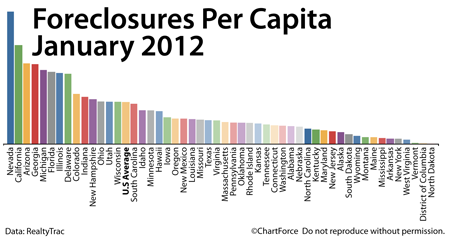

As in most months, January’s foreclosure activity was geographically concentrated. Nevada led the nation in Foreclosures Per Capita, followed closely by California. 13 states fared worse than the national average of 1 foreclosure per 624 households. 37 fared better.

The difference in foreclosure frequency among the two groupings was stark :

- Top 13 Foreclosure States : 1 foreclosure per 435 households, on average

- Bottom 37 Foreclosure States : 1 foreclosure per 5,101 households, on average

North Dakota had January’s lowest foreclosure rate nationwide. Just 1 in 63,500 homes was in some form of foreclosure in North Dakota last month.

As a first-time or seasoned buyer in Columbus , foreclosed homes can be enticing. They’re plentiful and cheap. However, just because a foreclosed home can be bought for a “steal”, that doesn’t mean it’s worth buying. The process of buying a foreclosed homes is different from the process of buying a non-foreclosed home.

The contract-and-negotiation process may be different with a foreclosed property, and foreclosed homes are often sold “as-is”. This means the home you buy at auction could be run-down and defective to the point where it’s uninhabitable.

If you plan to buy a foreclosed home, therefore, have a real estate professional on your side. The internet can teach you much about how the OH housing market works, but when it comes to writing contracts, you’ll want an experienced agent on your side.

Mortgage markets worsened last week as the Eurozone moved closer to a bailout agreement with Greece, and the U.S. economy displayed more signs of growth.

Mortgage markets worsened last week as the Eurozone moved closer to a bailout agreement with Greece, and the U.S. economy displayed more signs of growth.