Mortgage markets carved out a wide range last week, eventually closing slightly worse. Mortgage-backed bonds sold off early in the week on rising investor sentiment. Then, they reversed higher on prepared remarks from Federal Reserve Chairman Ben Bernanke, which tempered Wall Street optimism.

Mortgage markets carved out a wide range last week, eventually closing slightly worse. Mortgage-backed bonds sold off early in the week on rising investor sentiment. Then, they reversed higher on prepared remarks from Federal Reserve Chairman Ben Bernanke, which tempered Wall Street optimism.

When bonds prices rise, mortgage rates fall.

Conforming and FHA mortgage rates in OH edged higher on the week, and remain at a 5-month high.

According to Freddie Mac’s weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage is now 4.08% and the 15-year fixed rate mortgage is now 3.30%. Both loan types require an accompanying 0.8 discount points, plus a full set of closing costs.

1 discount point is equal to one percent of your loan size.

Last week’s conforming mortgage rates represent a sharp increase from the week prior when rates for the 30-year fixed rate mortgage and 15-year fixed rate mortgage averaged 3.92% and 3.16%, respectively.

If you’ve been shopping for a 30-year fixed rate mortgage, the interest rate increase added $9.22 to your monthly payment per $100,000 borrowed.

We can’t know in what direction mortgage rates will move this week, but we can be certain they’ll be volatile. Wall Street is suddenly on edge, unsure of whether the economy is improving as recent data suggests, or if the Federal Reserve is correct in that threats to growth persist.

The week’s data schedule is as follows :

- Monday : Pending Home Sales Index

- Tuesday : Consumer Confidence; Case-Shiller Home Price Index

- Wednesday : Durable Goods

- Thursday : Initial Jobless Claims; GDP

- Friday : Personal Income and Outlays

In addition, there are 6 Federal Reserve speakers scheduled for the week, including Chairman Bernanke. Expect mortgage rates to change frequently throughout the week as Wall Street wrestles with data and rhetoric.

Although mortgage rates spiked last week, historically, they remain low. If you’re nervous that rates may rise more, consider locking something in.

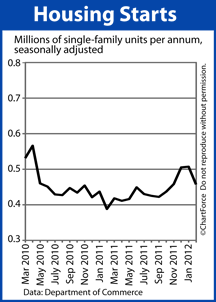

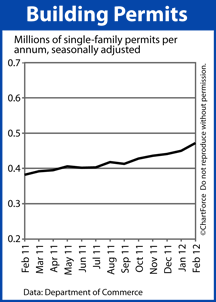

The new construction housing market appears primed for growth this season.

The new construction housing market appears primed for growth this season.