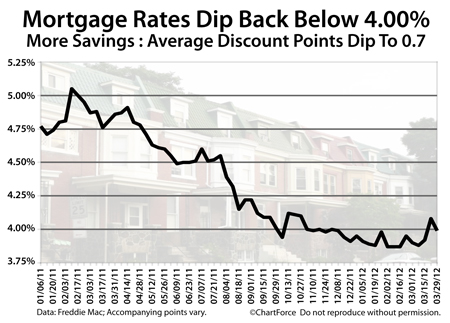

After a brief run-up two weeks ago, mortgage rates are back below 4 percent. It’s good news for home buyers and mortgage rate shoppers of Columbus because with lower mortgage rates come lower mortgage payments.

According to Freddie Mac’s weekly Primary Mortgage Market Survey, the national, average 30-year fixed rate mortgage rate fell to 3.99 percent this week from last week’s 4.08 percent.

Last week had marked the first time since December 2011 that the benchmark rate crossed north of 4 percent — a span of 16 weeks.

And, it wasn’t just rates that got cheaper this week — closing costs dropped, too.

Freddie Mac’s survey showed that the average number of discount points to accompany a 30-year fixed rate mortgage fell one-tenth of a percent this week to 0.7, where one discount point is equal to one percent of your loan size.

As a real-life example, a $200,000 Montgomery mortgage with an accompanying 0.7 discount points would be subject to an additional $1,400 one-time closing cost. Last week, that cost was $1,600.

Note, though, that these are average mortgage rates for the nation. On a local level, rates may be higher or lower, and so may the accompanying number of discount points.

For example, in this week’s Freddie Mac survey, each U.S. region boasts its own “average rate” :

- Northeast Region : 4.00% with 0.7 discount points

- West Region : 3.94% with 0.9 discount points

- Southeast Region : 4.01% with 0.8 discount points

- North Central Region : 3.99% with 0.6 discount points

- Southwest Region : 4.02% with 0.8 discount points

These rates are each well below the average rates of a year ago when the average 30-year fixed rate mortgage was 4.86%.

Low mortgage rates can’t last forever so if you’ve been wondering whether now is a good time to buy a home or refinance one; or whether rising rates will harm your monthly budget, the answer may be yes. A weak economy held mortgage rates low last year. An improving economy should push rates higher this year.

Talk to your loan officer and review your home loan options. Looking ahead to spring and summer, mortgage rates appear poised to rise.

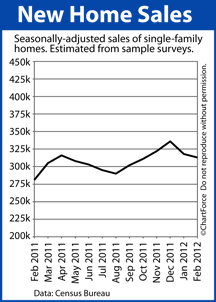

Sales of “new homes” fell to the lowest levels in four months last month.

Sales of “new homes” fell to the lowest levels in four months last month.