Americans continue to get back to work.

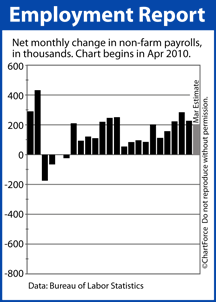

Last Friday, in its Non-Farm Payrolls report for the month of March, the Bureau of Labor Statistics announced 120,000 net new jobs created, plus combined revisions in the January and February reports of +4,000 jobs.

The March report marks the 18th straight month of job growth nationwide — the first time that’s happened in 5 years.

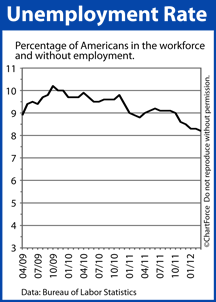

The Unemployment Rate dipped in March, too, falling one-tenth of one percent to 8.2%. This is its lowest national Unemployment Rate since February 2009.

Clearly, the jobs market is moving in the right direction. Yet, after the Non-Farm Payrolls report was released Friday morning, stock markets dropped and bond markets gained — the opposite of what a casual market observer would expect.

It happened because, although job growth was strong, Wall Street decided it just wasn’t strong enough. The market expected 200,000 jobs created in March at least and the actual reported figure fell short.

Lucky for you, Wall Street’s pain is Main Street’s gain. After the jobs report was released, mortgage rates immediately dropped to a 3-week low, making homes more affordable in OH and throughout all 50 states.

The market’s reaction is an excellent example of how important jobs data can be to home affordability — especially in a recovering economy.

The economy shed 7 million jobs between 2008-2009 and has since added more than half of them back. Wall Street pays close attention to job creation because more working Americans means more consumer spending, and more consumer spending means more economic growth.

Rate shoppers caught a bit of a break on the March payroll data. By all accounts, the labor market recovery in underway and, as it improves, higher mortgage rates are likely nationwide. For now, though, there’s a window for low mortgage rates that buyers and would-be refinancing households can try to exploit.

If you’re actively shopping for a home or a mortgage, today’s mortgage rates may be at “last chance”-like levels. Once rates rise, they’re expected to rise for good.

In a week of up-and-down trading, mortgage markets improved for the second consecutive week last week. Weaker-than-expected jobs data plus evidence of a slumping Eurozone took mortgage bonds lower, capped by a furious Friday morning rally that dropped mortgage rates to near-record levels.

In a week of up-and-down trading, mortgage markets improved for the second consecutive week last week. Weaker-than-expected jobs data plus evidence of a slumping Eurozone took mortgage bonds lower, capped by a furious Friday morning rally that dropped mortgage rates to near-record levels. If you’re out shopping for a home this week, or trying to lock a mortgage rate, with Friday comes home affordability risk. Consider locking your mortgage rate today.

If you’re out shopping for a home this week, or trying to lock a mortgage rate, with Friday comes home affordability risk. Consider locking your mortgage rate today.