Tuesday, the government released its March 2012 New Residential Construction report.

Tuesday, the government released its March 2012 New Residential Construction report.

The report is made up of three sections, each related to a phase of the “new home” market. The report’s first part is Building Permits; the second is Housing Starts; the third is Housing Completions.

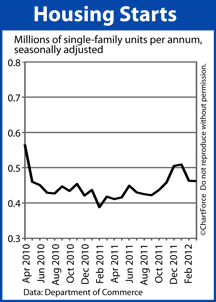

Of the three sections, it’s Housing Starts that gets the most attention from the press — mostly because, of the triad, it’s the simplest for a layperson to understand. However, the manner in which Housing Starts data is reported can be misleading.

Today’s newspapers offer up an excellent example.

According to the Census Bureau, total Housing Starts fell by 6% in March as compared to the month prior. 654,000 units were started on a seasonally-adjusted annualized basis.

For Housing Starts, it’s the lowest reading in 5 months, a statistic suggesting that the housing market may have lost some momentum. Much of the press covered the story from a “housing is slowing” angle.

A few published headlines include :

- U.S. Housing Starts Unexpectedly Drop To 5-Month Low (BusinessWeek)

- New Home Constructions Takes Pause (CNNMoney)

- A Delayed Winter For Housing (US World And News)

Although these headlines are accurate, they tell just half of the story.

Housing Starts did drop in March, but if we remove a subset of the data — structures with “5 or more units”; a grouping that includes condominiums and apartment buildings — we’re left with Housing Starts for single-family residences only. It’s this data that matters most to buyers in Cincinnati and nationwide.

Few home buyers buy entire apartment buildings. Most buy single-family homes.

In March, single-family Housing Starts were down 0.2% from the month prior, or just 1,000 units on a seasonally-adjusted, annualized basis.

That’s hardly a drop at all.

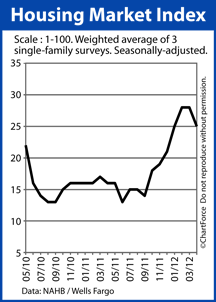

For the first time in 3 months, homebuilder confidence has slipped.

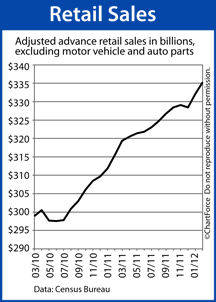

For the first time in 3 months, homebuilder confidence has slipped.  Mortgage markets improved last week as a global flight-to-quality continued. With Spain facing questions on its sovereign debt, investors continued to pare exposure to risky assets, sparking demand for the relative safety of U.S. government-backed mortgage-backed bonds.

Mortgage markets improved last week as a global flight-to-quality continued. With Spain facing questions on its sovereign debt, investors continued to pare exposure to risky assets, sparking demand for the relative safety of U.S. government-backed mortgage-backed bonds.