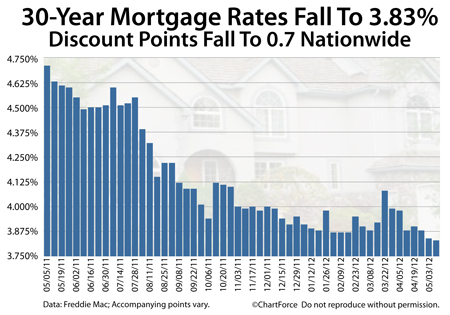

Conforming mortgage rates continue to drop.

For the second straight week, the 30-year fixed rate mortgage fell to a new, all-time low nationwide. According to Freddie Mac’s weekly mortgage rate survey, the average 30-year fixed rate mortgage rate dropped 1 basis point to 3.83% this week for borrowers willing to pay 0.7 discount points plus a full set of closing costs.

The 15-year fixed rate mortgage also set a mortgage rate record, registering 3.05% with an accompanying 0.7 discount plus closing costs.

Discount points are a one-time, up-front closing cost, based on loan size. 0.7 discount points is equal to 0.7% of the borrowed amount. A home buyer in Columbus opening a $200,000 mortgage and paying 0.7 discount points, therefore, would be subject to a one-time $1,400 fee paid at closing.

Borrowers wanting to avoid paying discount points can expect higher mortgage rates than Freddie Mac’s reported national average.

Falling mortgage rates are nothing new throughout Ohio. Since peaking in February 2011, mortgage rates of all types have been in steady decline. The 30-year fixed rate mortgage has shed 122 basis points since that date, falling from 5.05%; the 15-year fixed rate mortgage has shed 124 basis points, falling from 4.29%.

Low mortgage rates give today’s home buyers additional purchasing power, stretching home affordability to new heights.

Low rates also help existing homeowners to lower monthly mortgage payments. For example, as compared to mortgage rates just 15 months ago, homeowners refinancing into today’s 30-year fixed rate mortgage stand to save 13.4 percent on their respective mortgage payments.

A comparison :

- February 2011 : $539.88 principal + interest per $100,000 borrowed

- May 2012 : $467.67 principal + interest per $100,000 borrowed

A homeowner with a $300,000 mortgage at February 2011 30-year fixed rate mortgage rates would save $2,600 annually with a refinance to this week’s low rates. Even accounting for discount points and closing costs, the “break-even point” on savings like that comes relatively quickly.

Mortgage rates can’t be predicted so there’s no guarantee of low rates forever. If today’s rates meet your budget, consider locking something in. Speak with your loan officer about your options.

The economic recovery continues nationwide, but the recovery’s an uneven one.

The economic recovery continues nationwide, but the recovery’s an uneven one.