Homebuilder Confidence is on the rise once again.

Homebuilder Confidence is on the rise once again.

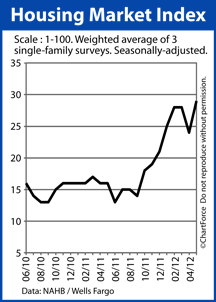

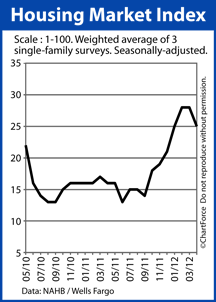

After a brief dip in April, the National Association of Homebuilders reports that the Housing Market Index rose 5 points in May to 29. The increase marks the sharpest climb in homebuilder confidence on a month-to-month basis in 10 years, and raises the index to a 5-year high.

The Housing Market Index is scored from 1-100. Readings above 50 indicate favorable conditions in the single-family new home market overall. Readings below 50 indicate poor conditions.

The HMI has not been above 50 since April 2006.

The Housing Market Index itself is a composite reading as opposed to a straight-up homebuilder survey. The published HMI figure is a compilation of the results of three specific questionnaires sent to NAHB members monthly.

The survey questions are basic :

- How are market conditions for the sale of new homes today?

- How are market conditions for the sale of new homes in 6 months?

- How is prospective buyer foot traffic?

This month, builders are reporting strong improvement across all three surveyed areas. Current home sales are up 5 points; sales expectations for the next six months are up 3 points; and buyer foot traffic is up 5 points to its highest point since 2007.

With mortgage rates low and home prices suppressed, the market for new homes is gaining momentum, a conclusion supported by the New Home Sales report which shows rising sales volume and a shrinking new home inventory nationwide.

The basics of supply-and-demand portend higher new home prices later this year — a potentially bad development for buyers of new homes in Kentucky and nationwide. With demand for new homes rising, builders may be less likely to make sale price concessions or to offer “upgrade packages” to buyers of new homes.

If you’re shopping for new construction in or around Cincinnati , therefore, consider moving up your time frame. Home affordability is high today. It may not be tomorrow.

Home affordability is receiving a boost from across the Atlantic Ocean this spring.

Home affordability is receiving a boost from across the Atlantic Ocean this spring. Mortgage markets worsened slightly last week as positive U.S. economic news overshadowed growing concerns for the Eurozone’s future. Political and economic issues continue to weigh on Greece and Spain, and it’s still unknown how France’s new President will change that nation’s fiscal direction.

Mortgage markets worsened slightly last week as positive U.S. economic news overshadowed growing concerns for the Eurozone’s future. Political and economic issues continue to weigh on Greece and Spain, and it’s still unknown how France’s new President will change that nation’s fiscal direction.