The April New Home Sales report suggests that the market for newly-built homes is as strong as the market for existing ones.

The April New Home Sales report suggests that the market for newly-built homes is as strong as the market for existing ones.

According to the U.S. Census Bureau, the number of new homes sold rose 3.3 percent in April to a seasonally-adjusted, annualized 343,000 units sold — its second-highest reading since April 2010.

April 2010 marked the last month of that year’s federal home buyer tax credit program.

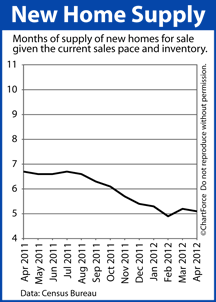

April’s New Home Sales data also marks the 7th of eight consecutive months during which the number of new homes sold climbed nationwide, a streak unequaled in recent history. During this period, the supply of new homes for sale has dropped 13%.

The complete new home inventory is down to 146,000 homes nationwide.

At the current pace of sales, home buyers in Columbus and across the county would exhaust the complete supply of newly-built homes in 5.1 months.

This, too, is a significant figure.

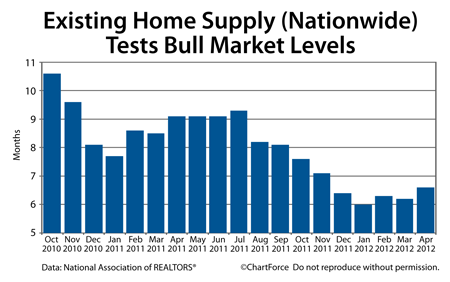

When home supplies fall below 6 months of inventory, it’s widely believed to indicate a “seller’s market” and there hasn’t been more than 6 months of a new home supply since October 2011. This has placed upward pressure on new home prices and helps to explain why the average home sale price is up 9% from just 6 months ago.

Homes are selling, and they’re rising in price — a trend that today’s buyers should expect to continue through the summer and fall months.

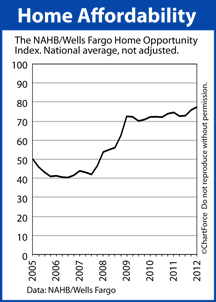

Record-low mortgage rates have moved home affordability to an all-time high with home builders now reporting the highest levels of buyer foot traffic at any time since 2007. As builder confidence grows, buyers can expect to find fewer “great deals” — especially as demand for homes outpaces supply.

If you’re a home buyer in search of new construction, therefore, the best new construction “deals” of 2012 may be the ones you find today. By 2013, the deals may be gone.

Falling mortgage rates and stagnant home prices are making a positive effect on home affordability nationwide. Never before in recorded history have so many homes been affordable to households earning a moderate annual income.

Falling mortgage rates and stagnant home prices are making a positive effect on home affordability nationwide. Never before in recorded history have so many homes been affordable to households earning a moderate annual income.